Chapter 6 Managing Portfolios of Insurable Risks

Chapter Preview. This book is designed to help technical analysts support the risk management function. As suggested in Chapter 1, the risk management function is broad and goes well beyond the scope of this book. Risk managers must first identify potential risks, think about how to mitigate them, and decide whether they are insurable. This book focuses on just one piece of this - the insurable portion. Nonetheless, it is helpful for analysts to become familiar with the broad scope of the risk function, and that is the purpose of this chapter.

To describe the broad scope of the risk function, Section 6.1 begins with fundamentals of risk control and transfer. Next, Section 6.2 summarizes methods available to the manager for transferring risk. These include methods for full retention, for full transfer, and approaches that are in between full retention and transfer. Section 6.3 delineates the types of coverages available from insurers. As examples, Sections 6.3.2 and 6.3.3 showcase studies that demonstrate how these different methods can be implemented. Section 6.4 looks to the future by exploring technology-driven tools being used in the insurance sector known as InsurTech as well as another tool, robo-advising, that is currently used in the financial sector and may someday migrate to the insurance sector.

As an alternative to traditional risk transfer approaches, Section 6.5 summarizes methods for decentralized insurance that includes a more detailed discussion of risk-sharing rules in Section 6.5.2. This builds upon Section 4.5 where we introduced general theoretical structures for exchanging risks. In contrast, this chapter delves into practical risk management methods used by various organizations. Although much of the recent literature on decentralized insurance and peer-to-peer exchanges is more geared for individuals, the main focus of this book is on risks faced by general commercial firms (not just insurers).

6.1 Risk Control and Transfer Fundamentals

Before deciding on a strategy for handling one or a set of risks, a risk manager’s first task is risk identification, assessing which risks are worthy of attention. Risk identification is industry and firm specific. The risks faced by a car wash franchise in Madison, Wisconsin are very different from those faced by an actuarial consulting firm in Canberra, Australia. As a consequence, this text does not further discuss the suite of potential risks that a risk manager must first identify except to acknowledge that this is an important step in the process. Readers may look to any of a number of excellent resources that introduce the risk management process, some of which are referenced in Section 6.6.

Having identified a set of risks, we know from Chapter 1 that some are insurable, some partially insurable, and some uninsurable. Stepping back a bit, this section considers risks in two parts, first in terms of risk control activities and then in terms of retention and risk transfer.

6.1.1 Risk Control Activities

Managers engage in risk control activities to mitigate, or lessen, the potential impact of risks. These activities serve to shape the risk distribution and therefore impact the decisions for financial risk transfers such as insurance. Risk managers have at their disposal a number of ways in which they can manage, and somewhat control, risks facing a person or firm. These include:

- risk avoidance,

- loss prevention and/or reduction, and

- risk control transfer.

Risk avoidance. The first decision is whether or not to take on a risk. A company considers risky projects in the face of competing opportunities: its capital position, management strategy, regulatory constraints, and many other aspects (such as administrative costs, acquisition expenses, runoff expenses, taxes, asset management fees, and profit). While risk avoidance is typically proactive, it may also occur after a loss, e.g., abandonment. Although the criteria for taking on (or abandoning) a risk are important, due to its industry-specific nature we will not dwell on this decision. In contrast, the emphasis here is on managing risks that a firm already has.

Nonetheless, “risk avoidance” is of particular interest when the firm is an insurance company. In this case, the company may elect to not take on risks through its underwriting process. For an insurer, risk control begins with underwriting, the process whereby an insurer decides on whether to accept or reject a risk, and then classifies a prospective policyholder into one of several established groups known as a “rating class,” thereby establishing a price range for an agreed upon insurance coverage. The uncertainty associated with this process is that premiums will be inadequate to cover insurance claims, both initially and over the life of the agreement. Additionally, there is a risk that several policies may submit claims simultaneously due to a large-scale calamity. For risk transfers, recall that reinsurers insure insurance companies (discussed in Section 4.1). We also note that the banking industry has this same type of underwriting ability to avoid unacceptable risks. However, because of the specialized nature of this industry, we do not seek to develop banking rules in this book.

Loss prevention or reduction. In general, loss prevention activities reduce the frequency of losses. In comparison, loss reduction activities are geared to lessen the amount of damage if a loss occurs and so reduce the severity. To be concrete, let us illustrate with some examples of loss prevention activities:

- Dams and water resource management can mitigate problems due to flooding.

- Shoveling, salting, and heated walkways can mitigate problems of icy sidewalks.

- Fire resistant construction of structures are less susceptible to fire.

- Security systems can prevent unauthorized access to data.

- Training programs can reduce the likelihood of injury.

For comparison purposes, here are a few examples of loss reduction activities:

- Installation of a sprinkler system. A fire needs to activate the system, thus not affecting frequency.

- Salvage. Even a loss for which an insured is compensated may be of some worth. For example, a totally damaged car may be sold for scrap. As another example, a damaged but repairable piece of equipment may be sold on a secondary market.

- Subrogration. After paying a claim, the insurer inherits the insured’s right to recoup losses from a responsible third party. Any money reclaimed from another responsible party reduces the net loss.

Risk control transfer. This type of risk control causes some entity, other than the firm experiencing the loss, to bear some or all of the risk’s financial burden. What is being transferred?

- The property or activity responsible for the risk may be transferred. As an example, a general contractor concerned about risk costs may transfer activities to a subcontractor (for a fixed price).

- The liability, but not the property/activity, may be transferred. For example, a retailer may assume responsibility for product damage that occurs after the product leaves the manufacturer (even if the manufacturer would otherwise be responsible). The contracts that implement such transfers are known as “exculpatory”.

In a risk control transfer, the “transferee” (the party accepting the risk) excuses the “transferor” (the party transferring the risk) from liability. The transferor’s exposure is eliminated.

A risk control transfer shifts the property or activity itself to another entity; it can also eliminate or reduce the transferor’s responsibility for losses to the transferee. This is in contrast to a risk financing transfer such as insurance, discussed in the next section, that will focus on providing external funds that will pay for losses that occur, not a transfer of liability.

6.1.2 Retention and Risk Transfer

Risk financing methods are used to provide resources to the risk owner that reimburse the cost of a loss. These methods can be categorized into two main types: retention and risk transfer.

- Retention. The source of funds for loss reimbursement is the organization, including borrowed funds that the organization must repay.

- Risk transfer. The source of funds for loss reimbursement is an external party such as an insurer. This method is also known as risk financing transfer to distinguish it from risk control transfer.

A company’s risk financing program uses a combination of retention and risk transfer, even on a specific risk. Complete transfer is atypical, as is full retention. On the one hand, many exposures to loss are so financially inconsequential that they can be safely retained and paid out of a company’s normal cash flow. On the other hand, an organization may not purchase any insurance or have other formal transfer agreements in place but transfer can still occur due to legal limits on liability, through limited liability inherent in the corporate form of the organization, or through bankruptcy law. Virtually every firm uses a combination of retention and risk transfer.

For many organizations, insurance pricing is based on the principle that, over time, they will bear the full cost of losses, except for rare catastrophes. Nonetheless, the decision of retention versus transfer can be affected by tax laws, generally accepted accounting principles, and civil law (that may treat retained and transferred losses differently).

Here are some broad considerations affecting the choice between retention and risk transfer.

- Firm Capacity. One element is the capacity of the organization to bear the loss. Without required capacity, the risk manager may be forced to seek alternatives to retention.

- Degree of Control. The organization’s degree of control over the risk affects the attractiveness of retention programs. The greater the control, the more attractive is retention. This is primarily due to moral hazard. Insurance has the potential to weaken incentives to prevent or reduce loss. In general, retention increases the incentives of an organization to establish and maintain loss prevention and mitigation activities.

- Expense Loadings. Other things being equal, a higher risk transfer loading fee (for expenses, cost of capital, and profits), means more retention.

- Services. Insurers can also provide valuable services to organizations, decreasing the attractiveness of retention. Loss adjustment and loss-control services are good examples. For contrast, some organizations believe that many of the services provided by insurers can be done better internally.

- Taxes. In general, tax laws often favor insurers over policyholders, making insurance more attractive.

- Other. There may be legal, economic, and public policy limitations on the transfer of risk.

For timing, both retention and risk transfer may be contemporaneous, prospective, or retrospective.

- Contemporaneous retention is simply paying for losses as they occur. It occurs without any advanced funding and is sometimes known as “pay-as-you-go.” For example, the peer-to-peer exchanges introduced in Section 4.5 are commonly pay-as-you-go. Section 6.5 discusses these exchanges in further detail.

- Prospective retention involves accumulating funds in anticipation of future losses. This is similar to insurance in that one pays now for future losses. Specific examples include:

- Liability or earmarked accounts that can absorb fluctuations in volatility, and

- Earmarked asset accounts. For example, a risk manager for a municipality could hold a trust fund account to pay for losses and avoid tax increases when losses occur.

- Retrospective retention involves payments to reflect past losses. To illustrate, consider the planned use of borrowing to finance potential losses, with repayments coming from future revenues. Retrospective agreements are common for large commercial firms with an abundance of capital.

Video: Section Summary

6.2 Corporate Risk Financing Methods

Complete transfer and pure retention represent opposite ends of a continuum; between these two ends lie a variety of methods combining transfer and retention.

- The transfer end of continuum contains guaranteed cost insurance, experience-rated plans, and retrospectively rated plans.

- The retention end of the continuum includes self-insurance, captive insurers, and finite or risk insurance plans.

- Methods in between these two ends include consumer proprietaries and cooperatives, self-insurance pools, risk retention groups, and administrative service/stop-loss plans.

6.2.1 Methods Emphasizing Risk Transfer

Insurance represents a classic method of risk transfer. Broadly, insurance is a transfer of uncertain risks for a certain price and can be viewed as a pre-loss financing method for future contingent claims. Within this broad classification, there are several features that affect the degree of risk transfer.

Guaranteed Cost Insurance. Here, the transferee, an insurer, agrees to reimburse the transferor, a policyholder, for losses incurred in exchange for a premium that is fixed at the time of the contract. Guaranteed cost insurance is on the end of the continuum where risk and uncertainty are fully transferred. This approach is widely used in personal insurance and may be the only one available to small and medium-sized organizations.

Experience-Rated Insurance is also known as “prospective experience-rating”. For this type of arrangement, a firm’s losses are used to update the insurer’s understanding of the policyholder’s risk profile; this information is used to formulate premiums for the next period. It is not an adjustment to current period premium.

Experience-rated plans are typically available to organizations with some degree of statistical credibility. They are widely used in workers’ compensation and general liability insurance. Through experience rating, the policyholder has some incentive to control losses through its risk management efforts. This direct control over a risk that in turn influences the premium makes this qualitatively different than the guaranteed cost approach.

Retrospective Rating is also known as “retrospective experience-rating”. Here, the premium is not known in advance but is determined after the policy period and is a function of losses incurred in the period. This resembles a “high-deductible” plan, with the exception that losses less than the deductible are paid by the insurer but then charged back to the policyholder as part of the “premium.” To complicate matters, retrospective rating may be used for coverages that take many years to develop (e.g., workers’ compensation) and so several adjustments to the “premium” may be made over time, involving different financial statements.

Prospective experience rating is more responsive to an organization’s losses than guaranteed cost insurance and retrospective rating is even more so. Retrospective rating is typically available only to large organizations.

6.2.2 Methods Emphasizing Retention

Self-insurance, in which the organization takes responsibility for losses from its risks, represents the most basic form of retention. Some writers modify this definition by imposing an additional constraint that a “self-insured” firm has special earmarked funds accumulated in advance to pay for potential losses.

Earmarking funds for potential losses may be viewed as a disadvantage to a firm; the opportunity cost is the difference between the return on alternative available investments in the firm and the lower return on the liquid self-insurance fund. However, even earmarked funds might not suffice to cover potential losses. The self-insurance fund might prove insufficient to cover potential losses which means that the firm would have to raise additional funds at the time of a major loss. If this difference were relatively large, such losses could have an adverse impact on the market price of a publicly-traded firm’s stock. Nevertheless, self-insurance is viewed as a viable option for large firms when the number of exposure units is sufficiently large for the risk manager to predict losses within some reasonable bounds, cf. Brockett, Cox, and Witt (1986).

Captive Insurers. A captive is an insurance company wholly owned and established by one or more non-insurance companies to insure the risks of its owners. Captives are a form of self-insurance whereby the insurer is owned wholly by the insured. The vast majority of Fortune 500 companies have captive subsidiaries, cf. NAIC (2020). Once established the captive operates like any commercial insurance company and is subject to an insurer’s regulatory standards including reporting, capital, and reserve requirements.

Several factors motivate captive use, including control over terms and conditions of the coverage being offered, cost efficiency, strategically leveraging (re)insurance market dynamics, and managing retained risk within a complex organization in a structured way, cf. Aon Risk Solutions (2019). Moral hazard and adverse selection present no issues with this arrangement because both insurer and insured are part of the same organization.

Most commonly, captives insure only the risk of its parent, known as a single parent or “pure” captive. In addition to single-parent captives, there are group/association captives, rent-a-captive, risk retention groups, agency captives, branch captives, senior or diversified captive, protected cell captive and producer owned reinsurance companies (PORCs), cf. State of Vermont (2020).

In the U.S., fronting is a technique for using a captive insurer to provide coverage when there is a requirement that insurance be provided by an insurer licensed in the state. A licensed insurer, the “front,” writes coverage for the parent company but does not retain responsibility, it reinsures the coverage with the captive.

Finite or Risk Insurance Plans. Essentially, these variations resemble banking arrangements in function. In this case, the “bank” is a separate entity that arranges and manages the plan for a self-insured entity. The simplest form of a banking arrangement could be a line of credit that an organization may draw upon in the event of unexpected losses. More elaborate schemes involve issuing debt instruments to fund potential losses. In these plans, the risk is spread across time rather than across exposures.

A common feature of finite insurance plans is the creation of a managed account of money. The firm makes premium payments into the account which becomes the principal source for financing losses. A contract is set, e.g., 3-5 years, and premiums are paid. The finite insurance provider may offer administrative services, may structure some excess insurance to cap losses, and may provide additional guarantees, e.g., interest rate guarantees on the account. Other banking services, such as cash management or line of credit, may also be provided. For the largest organizations, in principle there is little difference between a banking arrangement and a retrospectively rated insurance plan.

The finite risk principle can also be applied to reinsurance, cf. Insurance Information Institute (2023a)).

6.2.3 Methods Intermediate Between Risk Transfer and Retention

A wide variety of risk financing methods exist between methods emphasizing risk transfer and those emphasizing retention, as summarized below.

Consumer Proprietaries/Cooperatives. A consumer proprietary is a type of stock insurance company and is a private insurance pool where the stock is owned by its policyholders, similar to mutual insurers. For example, X.L. Insurance Co. Ltd and A.C.E. Insurance Co. Ltd have become major providers of large liability policies that cover only losses in excess of a given amount. The consumer cooperative is an older form of insurance. For example, Protection and Indemnity clubs are shipowner mutual insurers providing liability insurance to its members.

On the one hand, we can think of these organizations as providing something similar to a guaranteed cost insurance. On the other hand, due to the typically small number of organizations forming the pool, access to capital is limited and it may be that member organizations are actually retaining more risk than they would with a contract from an external insurer.

Self-Insurance Pools. These are arrangements whereby participating entities mutually agree to provide insurance coverage for each other. For instance, a dozen city governments may agree to finance workers’ compensation by pooling member contributions to pay claims and administrative expenses. The Wisconsin Property Fund introduced in Section 1.2.2 and further described in Section 6.3.3 is an example of this type of arrangement.

Occasionally, pools are incorporated as insurance companies. More often, they are formed under an intergovernmental cooperative agreement. By not incorporating as an insurer, they are not subject to insurance regulation and avoid certain insurance taxes. Are government sponsored pools more efficient than the commercial insurance market? As a matter of practice, their functions are indistinguishable from one another. Although there are a few pools in Europe and Australia, most are in the U.S.

Risk Retention Groups. A risk retention group (RRG) is a (limited liability) corporation whose primary purpose is assuming and pooling liability exposures of its members. Examples include:

- Groups offering environmental pollution liability coverage to firms in the electronics industry.

- Educators legal liability protection for colleges and universities.

- General and product liability coverage for livestock and pet food producers.

- RRGs write more medical malpractice coverage than any other line of business.

The U.S. Liability Risk Retention Act of 1986 created new opportunities for the creation of pools. Under this act, organizations are permitted to band together to set up RRGs for retaining liability exposure (other than workers’ compensation) and purchasing groups that can purchase liability insurance on a group basis for their members.

An RRG closely resembles a mutual insurer. In the U.S., it only needs to be licensed in one state and so avoids many expenses and delays than if it had to be licensed in each state in which it operates (the norm for insurers in the U.S.). More information about risk retention groups can be found through the National Association of Risk Retention (2023) or the National Association of Insurance Commissioners (2023b).

Purchasing Groups. These groups were also created by the same 1986 act. Like an RRG, a purchasing group must be composed of persons/entities with similar liability exposures by virtue of common premises or operations. Unlike RRGs, a purchasing group does not even have to be a corporation. For example, a trade association could create a purchasing group by passing a resolution.

Administrative Services Only (ASO) / Minimum Premium Plans or Stop-Loss Plans. ASO plans offer administrative services for claims processing. Under an ASO only plan, the plan sponsor is responsible for the financing. Sometimes, the ASO provider is an insurer.

Under a stop-loss plan, also known as minimum premium plan, the insurer provides the claim settlement service with the plan sponsor paying the claims themselves. The insurer guarantees a maximum cost (stop-loss) within a specified timeframe. For example, this maximum cost may be in terms of a monthly health claim cost per employee. This maximum cost is similar to the maximum premium in a retrospective rating plan.

Video: Section Summary

6.3 Commercial Insurance Coverages

What types of insurance are available to cover risks faced by businesses?

We started in Section 1.1 by citing a survey of risk managers that listed potential risks faced by businesses as well as by looking to OECD’s summary of the international marketplace for a sense of insurance coverages purchased globally. This section delineates insurance coverages available to protect businesses against insurable risks. I begin with more structured contracts suitable for small and medium-sized firms and then discuss more flexible arrangements desirable for larger firms.

6.3.1 BOPs and Commercial Insurance

So that firms need not purchase separate policies for different risks, it is common for insurers to offer a policy that covers several risks simultaneously. By bundling risks together into a single contract, such policies offer a convenient and cost-effective option for businesses that need a set of core coverages. These core coverages typically include general liability insurance, property insurance, and business interruption insurance. In the United States, such contracts are known as business owners policies (BOPs). In Europe, it is common to refer to them as a “package policies” or “combined policies” and, in Australia, as “business package policies” or “multi-peril insurance.”

In all jurisdictions, these policies bundle several essential coverages for small and medium-sized businesses into a single package. They are generally designed to provide standardized coverage packages meaning that the options for customizing risk retention may be limited. That is, the coverage limits and deductibles may be predetermined by the insurance provider based on the standard package offered. Even though these policies are designed to provide affordable and convenient coverage for a wide range of small businesses, the risk retention options may be less customizable compared to larger, more tailored commercial insurance policies.

A BOP is not limited to a single set of core coverages. It is common to add coverage for risks due to commercial auto, cyber liability, directors and officers, employment practices liability, and so forth, depending on the needs of the business.

Larger firms require more flexibility than afforded by a BOP. Commercial insurance typically refers to a broad category of insurance policies designed to protect businesses from various risks. Furthermore, it includes different types of coverage, such as general liability, property, workers’ compensation, and more, which can be tailored to the specific needs of a business.

To illustrate the need for flexibility, the following Section 6.3.2 presents the case of a large organization (a university) that has insurance needs comparable to a large commercial organization. For contrast, Section 6.3.3 describes an insurance pool of government entities, the Wisconsin Property Fund. Although not a commercial insurer, the fund functions similarly to one in that it provides standard policies which cover several risks for members of the pool. I feature both entities in this book because data are available that allows us to calibrate optimal insurable portfolios in the same way that a commercial insurer or risk advisor could do for its clients.

6.3.2 Australian National University Case

To give a concrete example of broad nature of the risk management function and commercial insurance coverage for several risks, this section returns to the Australian National University (ANU) case that was introduced in Section 1.2.1. ANU has extensive risk control activities in place focusing on risk avoidance, loss prevention or reduction, and risk control transfer, consistent with the general summary in Section 6.1. These activities are designed to mitigate the financial impact that a risk can have on the organization. Anticipating and reducing the potential impact of risks are key responsibilities of risk managers. You can learn more about ANU’s risk philosophy in an overview of ANU Risk Management Policy Statement, ANU (2022b).

Nonetheless, even with the best risk management processes, losses do occur and risk financing methods are needed to provide resources for recovering the cost of a loss. As described in Section 6.2, these methods fall into two broad classes: retention and risk transfer. ANU takes a layered approach to financing risks:

- At the lowest level, individual business units are responsible for handling small adverse outcomes. Business units may include departments, schools and colleges, and administrative units such as financial management.

- For small and intermediate outcomes, ANU has created a Self-Insurance Reserve (SIR) Pool.

- For potentially larger adverse outcomes, ANU transfers risks to external insurance companies (for a price).

- A type of risk sitting outside of this layered structure is workers’ compensation. This has a separate history and claims experience that is briefly summarized below.

Overview of Insurance Programs

The amount of risk retention and transfer depends upon the risk type. To understand the variety of risk types and the relationship among the different layers, Table 6.1 classifies various risk types. For example, for the building and contents of a property, individual business units are responsible for losses up to 15,000 (Australian dollars or AUD). Losses in excess of this go to the SIR pool. The pool retains losses but is reimbursed by insurers for losses in excess of 5,000,000. As another example, for cyber claims, individual business units have no responsibility and the pool manages all losses. But, losses in excess of 250,000 are reimbursed by insurers.

Table 6.1 summarizes 15 coverages and premiums paid in year 2020-2021. Data in Table 6.1 comes from information provided by Gallagher, a brokerage firm retained by ANU. For confidentiality reasons, Table 6.1 excludes the following coverages:

- Directors & Officers

- Excess Directors & Officers

- Directors & Officers Supplementary Legal Expenses.

The insurance program is important to the overall financial health of ANU. According to the 2020 Annual Report (page 96), total expenditures for ANU in 2020 were 1,315 (in millions). Thus, the 24,407,255 AUD in insurance premiums constitutes approximately 1.86% of total university expenditures.

As is evident from Table 6.1, the property risk is by far the most important, accounting for about 95% of the premium. Notably, the property deductible is currently 5,000,000 AUD, representing a large uninsured risk. The second most important risk type is General and Products Liability, representing 448,500 AUD in premiums or about 2% of the total. The other 13 coverages sum to 692,056 AUD that represents about 3% of the total.

Generally, different risks are associated with different insurers and so have different contracts. However, sometimes multiple risks fall under a single insurer. For example, Chubb takes on the expatriate, group personal accident, corporate travel, and a layer of the G & P Liability. In addition, sometimes multiple insurers get involved in a single risk. This is implicit for property risk and explicit for the general and products liability. For the G & P Liability risk, one can see a layered approach for the coverages.

| Class of Insurance | SIR Deductible | Insurer | Deductible | Limit | Premium |

|---|---|---|---|---|---|

| Property | 15,000 | London Syndicate and Others | 5,000,000 | 1,000,000,000 | 23,564,759 |

| General and Products (G & P) Liability | 5,000 | Newline | 100,000 | 20,000,000 | 340,000 |

| G & P Umbrella Liability | Liberty | 20,000,000 | 50,000,000 | 27,500 | |

| G & P 1st Excess Liability | QBE | 50,000,000 | 100,000,000 | 27,500 | |

| G & P 2nd Excess Liability | Chubb | 100,000,000 | 150,000,000 | 17,500 | |

| G & P 3rd Excess Liability | CGU | 150,000,000 | 200,000,000 | 16,000 | |

| G & P 4th Excess Liability | Zurich | 200,000,000 | 250,000,000 | 20,000 | |

| Cyber | NA | London | 250,000 | 2,000,000 | 75,721 |

| Crime | NA | AIG | 100,000 | 20,000,000 | 100,000 |

| Employment Practices Liability | 5,000 | AIG | 100,000 | 2,000,000 | 84,000 |

| Expatriate | NA | Chubb | 11,676 | ||

| Group Personal Accident | NA | Chubb | Various | As per schedule | 104,920 |

| Corporate Travel | NA | Chubb | Various | As per schedule | 75,000 |

| Professional Indemnity | NA | Newline | 100,000 | $20m / $40m | 130,000 |

| Medical Malpractice | NA | Newline | 100,000 | $20m / $40m | |

| Clinical Trial | NA | Newline | 2,500 | $20m | |

| Statutory Liability | NA | Berkley Insurance Australia (SUA) | $1,000 / $15,000 | 1,000,000 | 8,360 |

| Motor Vehicle | NA | Vero | 1,000 | As per schedule | 84,700 |

| Marine Cargo | NA | Richard Oliver (QBE) | 5,000 | 5,000,000 | 6,127 |

| Marine Hull | NA | Richard Oliver (QBE) | 150 | 5,000,000 | 11,552 |

| TOTAL | 24,407,255 |

More detailed descriptions of these coverages are available in Frees and Butt (2022).

Self-Insurance Reserve Pool

Major universities such as ANU allocate budgetary responsibilities by layers, beginning from smaller units such as colleges and departments. In addition, ANU owns or is affiliated with several other organizations such as ANU Enterprise Pty Ltd, ANU Union, and so forth. (ANU (2018) provides a list of “named insureds” organizations that participate.) To avoid each financially responsible unit purchasing insurance according to their own needs, in 1994 ANU organized the so-called “Self-Insurance Reserve” or SIR for short. According to the ANU (2022a), the SIR pool is “for insurance losses that except for the policy excess or coverage limit, would otherwise be covered under the commercial insurance program.” Through this mechanism, the university facilitates economies of scale and reduces costs of insurance purchases.

On the one hand, this mechanism affects incentives of units within ANU and so is important. See the ANU (2018) for more information about the structure and operations of the SIR pool. On the other hand, because the SIR pool is owned and operated by ANU, there is no external transfer of risk. In the context of risk financing, this level of detail could be ignored.

ANU Workers’ Compensation

Workers’ compensation provides cash and medical benefits to workers who are injured or become ill in the course of their employment and provides cash benefits to the survivors of workers killed on the job.

This risk has several features that warrant consideration of this coverage separate from other financial risks. These features include:

- Workers’ compensation benefits are typically paid out over several years. These benefits help to lower the cost and impact of work-related injury and illness through replacing income, paying medical and rehabilitation expenses, and for permanent impairment payments, all of which can occur over a long period of time. This is in contrast to most lines of general insurance where payments for claims are settled relatively quickly. It is true that claim settlement for some liability coverages can take a long time but these are exceptions to the general rule. You might think of an analogy to life insurances; in life insurance, the death benefit is paid rather quickly after a claim has been filed whereas for life annuity benefits, payments typically occur over the course of many years. In the same way, workers’ compensation benefits can occur over many years, depending on the recovery of the injured worker.

- In many countries including Australia, workers’ compensation coverage is mandatory for businesses. For other lines of general insurance, risk transfer such as insurance is simply good business practice yet is not required. Another exception to this rule is medical malpractice which is also typically mandatory. For mandatory coverages, there are typically additional regulatory scrutiny and administrative requirements compared to coverages that are not required.

- Although coverage is required, in many jurisdictions regulators provide options for self-funding, or self-insuring, this risk. Self-insurers often use outside firms known as third-party administrators to settle workers’ compensation claims, in part because of the administrative requirements imposed by regulatory scrutiny.

Given the context described in Section 6.2.2, it is not surprising that ANU essentially self-insures this risk. ANU is a large organization with financial capacity to absorb deviations in experience. Moreover, most workers’ compensation claims occur with high frequency and low severity relative to other risk classes, making it easier to manage. Further, to provide protection against very large unexpected claims, ANU subscribes to an insurance policy with a retention level of 750,000 per event. As at 31 December 2019 no claims have, or are expected to, exceed this retention level.

To get a sense of the size of this obligation, the 2020 ANU annual report (page 97) lists the current liability provision for workers’ compensation to be 2,588 (thousands of AUD) and the non-current liability provision to be 21,638 (thousands of AUD); the latter is a provision for future anticipated claims. This is further evidence that workers’ compensation claims are paid out over many years and is one reason that we do not advocate using the same liability portfolio methods as with the other risks that ANU faces.

For this risk, further information is available through the website ANU (2023).

Video: Section Summary

6.3.3 Wisconsin Property Fund Case

The ANU case describes an organization that manages risks inherent in its operations. In contrast, the Wisconsin property fund, introduced in Section 1.2.2, is a self-insurance pool formed under an intergovernmental cooperative agreement. This is an example of an organization that takes on risks in a manner similar to an insurance company.

The Wisconsin Local Government Property Insurance Fund (LGPIF) was established to provide property insurance for local government entities that include counties, cities, towns, villages, school districts, and library boards. The fund insures local government property such as government buildings, schools, libraries, and motor vehicles. State government buildings are not covered; the LGPIF is for local government entities that have separate budgetary responsibilities and who need insurance to moderate the budget effects of uncertain insurable events. Claims for state government buildings are charged to another state fund that essentially self-insures its properties. Coverage for state properties and local government units was established by the state in 1911 when it was difficult for these units of government to obtain reasonably priced coverage from the private sector. In 1979, this separate fund was established to provide insurance coverage to government properties not owned by the State of Wisconsin. The fund was dissolved in 2017, ostensibly because the private marketplace was sufficiently robust to provide the needed coverage at reasonable prices.

During its existence, the LGPIF acted as a stand-alone insurance company, charging premiums to each local government entity (policyholder) and paying claims when appropriate. As described in Section 1.2.2, the Property Fund tracks six coverage groups that can be treated as individual lines of businesses. Although the LGPIF was not permitted to deny coverage for local government entities, these entities could work with the open market to secure coverage. Thus, the LGPIF acted as a “residual” market to a certain extent, meaning that other sources of market data may not reflect its experience.

When considering the balance between risk retention and risk transfer, it is natural to consider three perspectives:

- A typical fund member that is interested in minimizing the uncertainty of its retained risk given a pre-determined maximum level of risk transfer contribution to the fund.

- The fund itself, or the pool of retained risks from all fund members. From this perspective, the fund may seek to transfer a portion of its retained risk to an external party such as an insurer/reinsurer.

- The reinsurer. Here, the perspective is that, for a price, a reinsurer has agreed to take on all risks except a designated portion that typically includes small routine claims.

Section 8.1 will consider the details underpinning each risk retention problem. Interestingly, each perspective represents a different optimization problem that naturally leads to different, and sometimes conflicting, retention policies. However, note that when the fund pool considers retention limits for a typical member it will balance that member’s retained risk with others in the portfolio. In the same way, when the fund transfers risk to a reinsurer, the reinsurer will also consider other risks that it retains. Thus, although the three perspectives appear to be in direct conflict, conflicting interests are mitigated by the presence of other risks not directly included in each optimization problem.

Video: Section Summary

6.4 Robo-Advising and InsurTech

Technical analysis of the balance between risk retention and risk transfer constitutes a type of technological innovation in the insurance sector, a field that has become known as InsurTech. To see how this fits, this section provides an overview of InsurTech, beginning with an introduction to FinTech while emphasizing a specific type, robo-advising.

6.4.1 Introduction to Robo-Advising

What is Robo-Advising?

Methods for solving the Section 3.4 asset allocation problem continue to evolve and remain relevant in part because they form the backbone of robo-advising. A robo-advisor (RA) is an automated digital financial system that provides financial advice with limited human intervention. These digital wealth management platforms provide investment solutions primarily focused on passive and cost-efficient instruments, while efficiently managing these allocations using rebalancing mechanisms. Robo-advisors are designed to incorporate inputs received from the investor.

The robo-advising industry started in 2007 by new entrants who saw it as an opportunity to bring advice to customer segments too small for traditional financial advisors. A core innovation of robo-advisors is the automation of wealth management processes that traditionally have been manual; robo-advising refers to attempts made to automate any part of the investment management process.

According to Morningstar Report (2022), industry-wide assets were around 440 billion USD at year-end 2021. Although large, it made up only a small fraction of the 27.9 trillion USD U.S. retail market. Like other aspects of the digital economy, future generations of clients are anticipated to welcome robo-advising and fuel its future growth.

How does an RA work?

As described in Grealish and Kolm (2021), robo-advising platforms begin collecting client information that includes age, net worth, investment goals, risk capacity and risk tolerance. The investment goals may include generating income, saving for retirement, planning for large future expenditures (such as the purchase of a house), and establishing a financial safety net for emergencies.

Next comes implementation of the investment strategy that can involve selecting a set of investment options such as exchange-traded funds (ETFs) followed by portfolio optimization. (An ETF is a bundle of securities that one buys or sells on a stock exchange.) Portfolio optimization may be based on the mean-variance asset allocation strategy or extended versions using alternative risk measures such as expected shortfall. Some robo-advisors incorporate additional features into their models such as transaction costs, tax strategies, and subjective viewpoints.

Robo-advisors are also used in the ongoing management of the investment strategy. Portfolios typically require rebalancing for shifts in market movements, unforeseen changes in cashflows, or opportunities for “tax-loss harvesting.” (Tax-loss harvesting means that one sells investments that are down, replaces them with similar investments, and use the losses to offset other realized taxable investment gains. The net result is a savings in taxes paid.) Some robo-advisors also provide updated automated advice as the investor approaches retirement or other major lifestyle changing events that affect asset consumption patterns.

Benefits of an RA

An important benefit of RAs is the lower costs attained through the use of technology. As summarized in D’Acunto, Prabhala, and Rossi (2019) and Beketov, Lehmann, and Wittke (2018), robo-advisors have several strengths when compared to traditional financial advisors.

- They offer various options to control, customize, and construct investment portfolios from multiple devices (such as smartphones and laptops). The technology can simplify and speed up contact with clients. RAs also have transparent workflow and monitoring systems, requiring a low minimum investment.

- Robo-advisors enjoy greater simplicity and efficiency in implementing strategies due to built-in automated algorithms.

- Robo-advisors typically use replicable algorithms that utilize advanced quantitative methods of portfolio management and optimization. As one consequence, RAs do not suffer from potential biases that human advisors may have. The interaction between human advisors and clients often resembles a sales transaction in which the advisor has an incentive to maximize personal incentives that may differ from an investor’s interests.

6.4.2 What is FinTech?

Robo-advising is the delivery and execution of financial advice through automated algorithms on digital platforms. Thus, it falls squarely into the sector known as FinTech, an abbreviation for financial technology. This is a term used to describe any technology that delivers financial services digitally; it may include online banking, mobile payments, and cryptocurrency. As described in Benamraoui and Abdulkader (2020), other types of FinTech include:

- Trading is a popular area for machine-learning/artificial intelligence (AI) applications. Considering the growing speed and complexity of trades, AI techniques are becoming an essential part of trading practice. These techniques have the capacity to analyze large amounts of data to generate trading signals. Algorithms can be trained to automatically execute trades based on these signals, which has given rise to the industry of algorithmic (or “algo”) trading. In addition, AI techniques can reduce transaction costs by automatically analyzing the market and subsequently identifying the best time, size, and venue for trades.

- Digital lending is the use of digital platforms to originate and renew loans in order to deliver faster and more efficient decisions. Online technology could be used to improve traditional banking relationships but also be used for non-traditional mechanisms, such as crowdfunding and peer-to-peer (P2P) lending. The concept of crowdfunding continues to evolve since it emerged to fund charities and facilitates improved access for businesses to investors. Crowdfunding capitalizes on social networks and online platforms by drawing on small contributions to fund a project. In contrast, P2P lending has achieved this by removing the middleman and connecting borrowers and lenders directly to one another. P2P lending usually takes the form of business loans or lines of credit. Investors typically provide funding assets through a lending platform.

- Blockchain. The blockchain technology can be described as a decentralized ledger that keeps a permanent record of digital transactions while also ensuring the purity of digital information. Blockchains overcome the need for third-party organizations or central administrators; only the participants in the blockchain control the network without any intermediaries. Blockchains have enabled organizations to automate their transactions to improve the flow of information between the organization and its external stakeholders.

6.4.3 What about InsurTech?

Many of these financial innovations can be applied directly, or adapted to, the insurance sector. InsurTech is a term used to describe any technology that delivers insurance services digitally, as in Cortis et al. (2019). The evolution of InsurTech is based in part on newly available data and can be described in terms of the insurance activities that it influences.

Data

As with FinTech, the explosion of interest in InsurTech has been partially driven by the increasing volume and breadth of data. Three types of data which have already made important impacts on pricing and underwriting insurance activities are:

- Mobile devices and wearables can generate massive amounts of data from sensor-equipped mobile devices and wearables. Early marketplace entrants were those of a wrist-borne nature but now wearables include fashion items such as jewelry, clothing and shoes. As these devices become more affordable to the general public, insurers benefit from this surge of available data to improve their pricing models for life and health insurance.

- These wearables can capture biometric information such as those from physical activity (e.g., number of steps, time spent sitting, miles cycled), cardiovascular measures (heart rate, heart rate variability, ECG, blood pressure), sleep data (quantity and quality), body temperature, galvanic skin response, blood sugar and even pollution exposure.

- Auto telematic devices can pick up diverse driving metrics such as location, time of day, mileage, driving frequency, behavior around hazardous zones, speed, rates of acceleration and braking habits.

- Home sensors and the Internet of Things (IoT). The network of physical devices embedded with sensors and connectivity, allowing the transmission and communication of data, forms the Internet of Things (IoT). Applications range from smart home devices (e.g., smoke alarms, thermostats and fridges) to environmental monitoring (e.g., examining air and water quality) and have permeated the market.

These variables not only impact pricing and underwriting but also allow consumers to assess their own outcomes on a timely basis. Insurance agreements can be established to encourage better consumer behavior (e.g., slow down speedy driving) and thus provide real benefits to society.

Examples of big data include text, audio, images, and video files that are known as unstructured data. The insurance industry as a whole is actively experimenting and developing approaches for incorporating these massive sources of data into their insurance activities. Table 6.2 summarizes new types of data sources that lead to new data.

Table 6.2. Analytic Trends (from Frees and Gao 2020)

\[ {\small \begin{array}{l|l} \hline \textbf{Data Sources} & \textbf{Algorithms}\\ \hline \text{Mobile devices and wearables} & \text{Statistical learning} \\ \text{Auto telematics} & \text{Artificial intelligence}\\ \text{Home sensors (Internet of Things)}& \text{Structural models}\\ \text{Drones, micro satellites} &\\ \hline \textbf{Data} & \textbf{Software} \\ \hline \text{Big data (text, speech, image, video)} & \text{Text analysis, semantics} \\ \text{Behavioral data (including social media)}& \text{Voice recognition}\\ \text{Credit, trading, financial data} & \text{Image recognition} \\ & \text{Video recognition} \\ \hline {{\tiny \textit{Source}:\text{Stephen Mildenhall, Personal Communication}}} & \\ \hline \end{array} } \]

Insurance Activities

Underwriting Process. The underwriting process is undergoing extensive transformations due to the introduction of AI algorithms. The business lines most readily digitized are those that have smaller potential losses and can be processed readily such as travel, event, and car insurance. Even when the process requires human intervention, AI can aid in almost every scenario, allowing underwriters to pull in external data in order to strengthen their decision-making processes. It is likely that all underwriters will be using digital technologies to support their underwriting decisions over time. Some analysts foresee that underwriting as we know it today will eventually cease to exist for most personal and small-business products across life and property and casualty insurance.

Claims Management Process. As with the underwriting process, AI is making a major impact on claims management associated with smaller, more frequently occurring claims such as auto insurance. Using AI image analysis and automated estimation algorithms, claims estimators can quickly resolve claims more accurately. For example, the AI can process a photo of vehicle damage and provide an estimate of the cost based on factors such as the size and orientation of a dent. Noncomplex claims are approved within seconds while complicated claims are handed over to humans in the claims department.

In addition to claims settlement, insurers may employ AI fraud investigation systems that identify potentially fraudulent claims. Such systems can investigate social media accounts, criminal records, property and vehicle history and other documentation submitted with the claim, thus enabling more time for the claims department to analyze results and close claims in a timely manner. Similar services that weed out possible fraudulent policyholders at underwriting stage are available in the market.

Distribution and Customer Interaction. Distribution is the process of delivering products or services into a target market. Like underwriting and claims management, AI has already impacted distribution channels for lines of business with smaller, more frequently occurring claims such as auto insurance. For these lines, the traditional quotation and policy issuance process is time-consuming and error prone. As alternatives, some InsurTech platforms use AI to streamline the process and automatically generate a quote, helping underwriters and brokers save time and issue policies faster.

In addition, insurers increasingly utilize chatbots to communicate with existing and potential customers. A chatbot is a digital service capable of holding natural-sounding conversions with individuals to accomplish a particular task, such as answering consumers’ questions, providing guidance, checking billing information, and addressing common inquiries and transactions.

Another potential disruptor for insurance distribution channels is peer-to-peer (P2P) insurance. P2P insurance is a risk-sharing network where a group of people pools their premiums together to insure against a risk. Modern implementations of P2P are technology enabled. Because it also offers a fundamentally different approach to risk sharing, we discuss this innovation in a later section.

6.4.4 Managing Insurable Risks Portfolios

Currently, most InsurTech activities can be classified as facilitating the pricing, underwriting, claims management, and distribution and customer interaction processes of insurers. Moreover, blockchain and P2P insurance have the potential to encourage innovative risk-sharing models.

However, one notable absence is the development of any tools comparable to robo-advisor in the insurance sector. As described earlier, from a technical viewpoint a robo-advisor can be thought of as a solution to the asset allocation problem, coupled with client information for a tailored solution (not just a frontier) that incorporates a digital platform to execute the financial advice through automated algorithms on digital platforms.

This book proposes a framework for constructing risk frontiers for insurable risk portfolios, paving the way for potential digital applications in the future. Conceptually, it is not difficult to imagine gathering additional information about firm attributes, a risk manager’s risk tolerance, and other preferences for the development of a digital platform to execute the financial advice through automated algorithms. As with the early development of robo-advising, it is likely that this solution would initially be most useful for small and moderate size firms.

Video: Section Summary

6.5 Decentralized Insurance

Building upon the “risk owner - risk taker” framework, Section 4.5 introduced the concept of risk sharing among multiple parties, historically motivated by insurance and reinsurance companies exchanging risks. To a lesser extent, this framework also applies to risk-sharing among like-minded businesses, such as the pools and risk retention groups described in Section 6.2.3. This section broadens this discussion by extending risk-sharing concepts to individuals that is coming to be known as decentralized insurance. Our focus is on a peer-to-peer (P2P) business model, a specific type of decentralized insurance.

6.5.1 Decentralized Insurance and Reciprocal Insurance Exchanges

Sharing Economy. With the explosion of the sharing economy and internet technology, many industries have adopted decentralized peer-to-peer concepts. For example, Uber, AirBnb, and eBay, are wildly successful start-ups that brought P2P business models to their respective taxi, hotel, and products industries. These firms succeed not by buying fleets of taxis, chains of hotels, or warehouses of goods, but rather by connecting consumers to people like them, their “peers,” who can provide the desired good or service.

Reciprocal Insurance Exchanges. The sharing of uncertain risks among like-minded individuals or firms is not new but rather reflects the origins of mutual insurance dating back centuries, cf., National Association of Insurance Commissioners (2023a) and Feng (2023). This sharing principle is reflected directly in the mission of mutual insurers where members care for each other’s financial needs in the event of misfortune. As will be seen, decentralized insurance frameworks most closely resemble traditional reciprocal insurance exchanges cf. Rego and Carvalho (2020). A reciprocal insurance exchange is an organization where policyholders directly exchange insurance contracts with one another. Unlike a mutual insurance company, it is an unincorporated association, not a traditional corporation. In the United States, the association administrator is known as an attorney-in-fact and policyholders are called subscribers. Although reciprocals are far less common than mutual and stock insurers, some major insurance providers are organized as reciprocals, notably USAA and Farmers Insurance. Reciprocal insurance exchanges are less common in Europe and Asia compared to the United States, but they do exist in several countries. Lloyd’s of London, a risk exchange that provides marine and specialty insurance for diverse risks, is a well-known example.

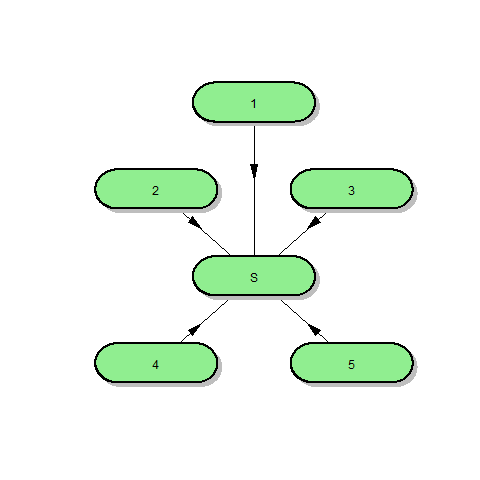

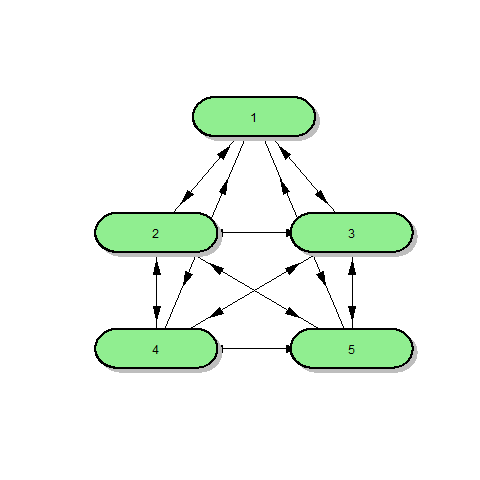

Decentralized Insurance. Traditionally, insurance companies have operated as central authority figures for groups of policyholders. They enter into contracts with policyholders to take on a portfolio of risks, collect premiums, pay claims, and set aside reserve funds for future obligations. This structure contributes to the reputation of insurance as a service industry with high expenses. The left-hand panel of Figure 6.1 is a schematic of this business model, with policyholder risks scattered around the insurer at the center.

Figure 6.1: Centralized versus Decentralized Approaches to Risk Sharing. The left-panel provides a schematic for a centralized approach, the right-hand panel is for a decentralized approach.

The right-hand panel of Figure 6.1 is a schematic of a decentralized network where the central authority figure is absent. In decentralized insurance, the role of market intermediaries is reduced or eliminated. It is sometimes also referred to as disintermediated insurance, as such practices bypass or cut out the central insurer role as a middleman. Just as Uber does not maintain a fleet of taxis, the administrator of a decentralized insurance network does not accumulate premiums and claim obligations which results in much lower overhead for central administrative expenses than a traditional insurer.

Figure 6.1 also suggests that administration of a decentralized insurance model can be more complex than a traditional insurer model. This complexity has been addressed by recently developed technology that permits participants to pay premiums/contributions, make claims, and receive claim payments readily. Moreover, some systems utilize blockchain technology for premium and claim payments coupled with bitcoins to further reduce transaction costs. According to the National Association of Insurance Commissioners (2023a), Teambrella claims to be the first P2P insurer using this model based on bitcoin.

Traditional Insurance versus Decentralized Models. What are the strengths and limitations of traditional insurance delivery systems when compared to the newer decentralized models? According to Feng (2023), traditional models offer three important advantages:

- Standardization of policies. Insurers use common policies and practices, reducing administrative costs.

- Single authority figure. Each policyholder deals only with an insurer which can reduce confusion and anxiety for consumers.

- Economies of scale. Insurance is an expensive service industry and insurers can spread costs and achieve economic efficiencies by taking on many risks.

In addition, traditional models have significant limitations:

- Insurance premiums are high relative to the actual cost of benefits. This is the most significant limitation in terms of motivating the introduction of modern decentralized platforms. Insurance is a high expense and service industry. Some services, such as claims adjudication, and some expenses, such as compliance with government regulations, are necessary. However, others such as agent commissions, costs of solvency capital, overhead, and so forth, are due to the central authority figure structure and are thought to be mitigated with a decentralized system.

- Concentration of market power. Because insurers need a requisite amount of capital to operate, this necessarily restricts entrance to the marketplace. Moreover, in many jurisdictions, relatively few insurers have a significant portion of the market share, giving the impression that they have undue influence on insurance policy decisions.

- Lack of trust in the insurance industry. Fraud is a major concern for insurers, many claimants believing that a slight misreporting of facts can help their case for payments significantly while not really hurting the financial situation of a major insurer. In contrast, particularly for a small group of family members, friends, or individuals with common interests who combine their premiums to insure against risks, it is thought that a decentralized model can result in a lower incidence of fraudulent claims. Fraud can be addressed through a variation known as a “broker model” to be introduced in Section 6.5.2.

Models without Insurers. Some decentralized systems adopt a pure mutual approach, where risks are shared among participants without any transfer to an insurance company. These models are developed entirely outside the traditional insurance sector and sometimes known as “self‐governing models,” or “no‐insurance‐company models.” Like reciprocal insurance exchanges, these systems have no separate legal personality but only organize indemnity agreements among participants.

For instance, China’s “mutual aid platforms” illustrate this approach. As one example, Xianghubao (a subsidiary of Ant Financial) was introduced in October 2018 and in less than a year had amassed more than 100 million users. It was organized to provide benefits that are payable upon the diagnosis of critical illness (such as cancer). When a member joins the platform, that person is obligated to split the cost of mutual aid with others at the end of each month. Thus, the business model does not involve an insurer. Xianghubao was closed in early 2022 due to regulatory changes, industry challenges, and strategic decisions by the parent company. See, for example, Abdikerimova and Feng (2022) and Feng (2023) for further discussions of this interesting case.

Models with Insurers. Many innovative technology exchanges have been organized by insurers or insurtech firms serving the insurance industry, so it is natural for these models to include the presence of an insurer. Moreover, for exchanges among individuals, it is natural to include insurers in order to limit potential obligations of participants by transferring tail risks to insurers.

According to the classification proposed by Rego and Carvalho (2020), the dominant type of P2P insurance is the P2P broker model. The main distinctive features of this model are as follows.

- Participants form groups (mainly online). A portion of their premiums goes into a common fund, while the rest gets paid to an insurance or reinsurance company.

- If the common fund is insufficient to pay for the claims then the insurance carrier pays the excess over retained premiums.

- Conversely, if the pool has few claims then the surplus is given back to the participants or to a cause the pool members care about.

The risk and insurance literature cites Friendsurance, a German startup launched in 2010, as the first to enter the market as a P2P model.

6.6 Supplemental Materials

6.6.1 Further Resources and Readings

Actuaries and other financial analysts will enjoy learning more about the fundamentals of risk control and transfer as outlined in Section 6.1. To this end, see some classic references including Willams, Smith, and Young (1995), Huebner, Black, and Web (1996), Harrington and Niehaus (1999), and Skipper and Kwon (2007).

If you would like to learn more about the commercial insurance coverages, see Insurance Information Institute (2023b), NAIC (2023), Metz and Valentine (2023), and Serpa and Krishnan (2017).

You can learn more about reciprocals in Mayers and Smith (2000) or via popular outlets such as Yates (2023).

Decentralized insurance has received substantial attention recently, both from industry and academia. For a regulator’s perspective, see National Association of Insurance Commissioners (2023a). In addition to the references cited in Section 6.5, see the works of Michel Denuit and co-authors as in Denuit (2020), Denuit and Robert (2021b), among others, for the foundations of this rapidly developing literature. From the perspective of this text, we look forward to the time when this stream of thought takes on the case of multivariate risks.