Excess of Loss for Two Risks

Chapter Preview. Risk owners want risk transfer agreements that limit the amount of retained risk. This is true for a single risk, where upper limits were introduced in Section 2.2, as well as for several risks, where multivariate excess of loss contracts were introduced in Section 4.1.2. Not only is this feature intuitively appealing, it has also some theoretical basis as seen in Section 3.1. Furthermore, as Chapter 1 noted, upper limit contracts serve as a “basic building block of insurance” (Mildenhall and Major (2022)), making them a fitting starting point for our investigations.

For analysts, upper limits are challenging because of the discrete jumps induced by the minimum operator. For example, even with a single risk we saw in Figure 2.3 how the distribution function changes dramatically above and below an upper limit. These jumps indicate that uncertainty measures might be non-linear and non-smooth (that is, not differentiable). This chapter develops approaches for handling these complications in the context of excess of loss policies.

To focus on fundamental issues, this chapter considers only two risks. Specifically, we now consider two risks \(X_1, X_2\) whose dependence is quantified through a copula \(C\). With \(u_1, u_2\) as the upper limits, the random variable of interest is the retained risk, \(S(u_1, u_2) = X_1 \wedge u_1 + X_2 \wedge u_2\). By focusing on only two risks, this chapter leverages deterministic methods to provide solutions for risk retention problems. For problems with more than two risks, beginning in Chapter 7 we will focus on solutions that employ simulation techniques.

Even for these more complex problems, the foundations using deterministic methods presented in this chapter can be useful. For example, you might be working with a risk retention problem with ten risks that is far too complex to evaluate using deterministic methods. A common procedure is to combine risks so that only two risk categories remain. These two risks can be evaluated using both deterministic and simulation methods. In this way, the deterministic approach serves as a check on the accuracy of the simulation approach. When both methods agree closely, then the simulation approach can be extended to address important practical problems involving more than two risks.

Because the bivariate excess of loss policy is fundamental to multivariate risk retention problems, this chapter examines it in detail. The beginning Section 5.1 establishes that this is not a convex problem meaning that one can only employ numerical approximation methods designed to yield local solutions. Section 5.2 develops the distribution of retained risk and Section 5.3 examines differential changes in the associated risk measures. The visualization in Section 5.4 helps one interpret the optimization problem.

Section 5.5 examines the excess of loss risk retention problem by looking at a special case when the budget constraint is binding. As will be seen, the analysis is very complex even with only two risks. Because of this complexity, it is unlikely that practicing analysts will take an interest in implementing this approach in problems with more than two risks. As another consequence of this complexity, many readers can safely skip this section on their first reading. Nonetheless, this section is important because the dimensionality reduction enjoyed by imposing active constraints may be appealing in some situations. So, by learning about the potential pitfalls described in this section, analysts will be in a better position to guide consumers on appropriate strategies for minimizing risk uncertainty when subject to budget constraints.

Lack of Convexity

As we learned in Section 4.4.1, the task of constrained optimization becomes immensely simplified if the problem at hand is convex. With convex optimization problems, solutions are globally optimal, not merely locally. Moreover, there exists a rich suite of algorithms for convex optimization (cf. Boyd and Vandenberghe (2004)) that are reliable and work well on large-dimensional problems.

Our discussion of convexity began in Section 2.4. Recall a function \(h\) is convex if a linear (convex) combination of a function evaluated at points is greater than or equal to the function evaluated at the same combination of points. That is,

\[

c~ h[{\bf u}_a] + (1-c)h[{\bf u}_b] \ \ge \ h[c {\bf u}_a + (1-c){\bf u}_b] \ \ \text{ for } \ \ \ 0 \le c \le 1 .

\]

This section demonstrates by means of examples that risk retention problems involving upper limits (and by extension, deductibles) are not convex (nor concave). This means, as summarized in Section 4.4, that we will require general numerical methods that do not assume convexity.

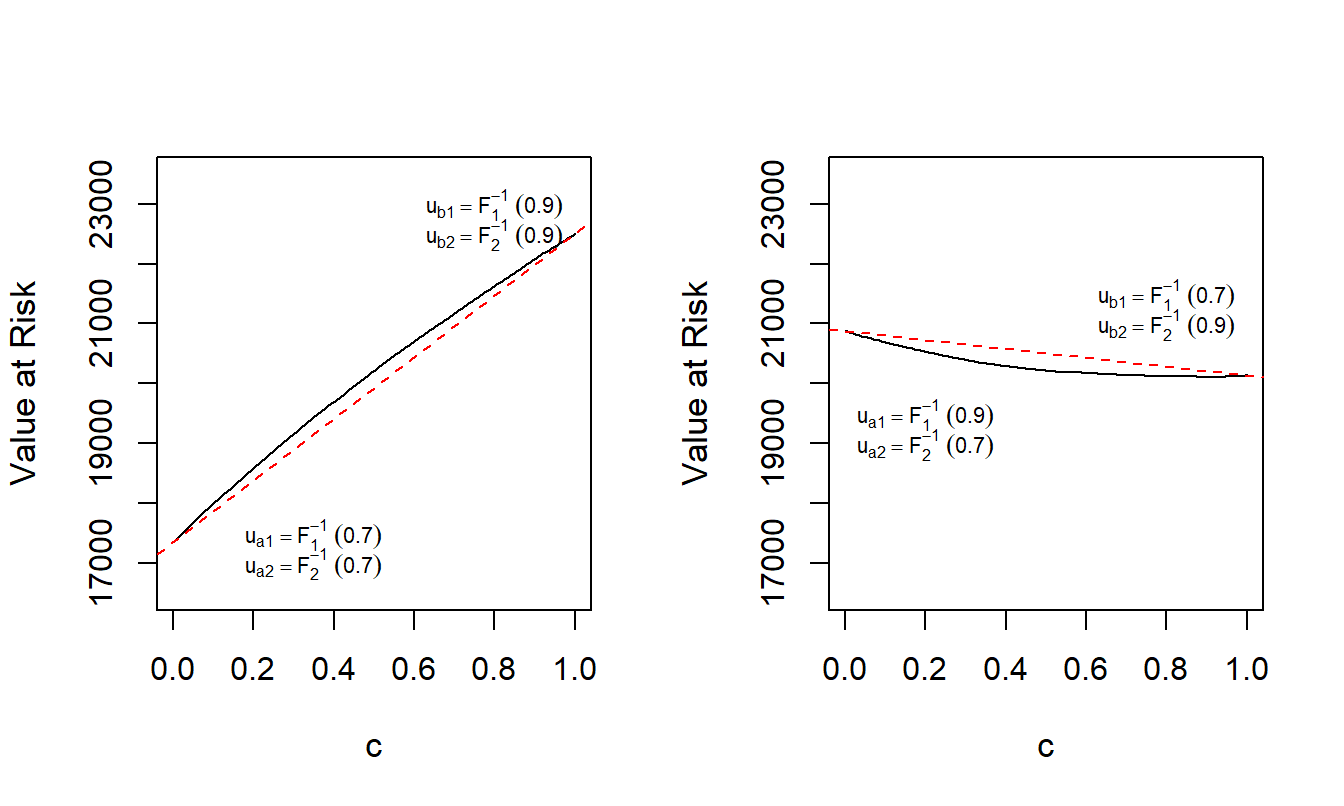

Example 5.1. Lack of Convexity of Value at Risk for Excess of Loss. Suppose that \(X_1\) has a gamma distribution with shape parameter 2 and scale parameter 5,000 so that the mean is 10,000. Suppose that \(X_2\) has a Pareto distribution with shape parameter 5 and scale parameter 25,000 so that the mean is 6,250. The two variables are related through a Gaussian copula with parameter \(\rho=\) -0.3. We seek to evaluate the value at risk with confidence level \(\alpha = 0.90\) for an excess of loss random variable \(S(u_1, u_2) = X_1 \wedge u_1 + X_2 \wedge u_2\), denoted as \(VaR_{0.9}(u_1,u_2)\). We plot \(VaR_{0.9}(u_1,u_2)=VaR_{0.9}({\bf u})\) for various values of \({\bf u} =(u_1,u_2)\).

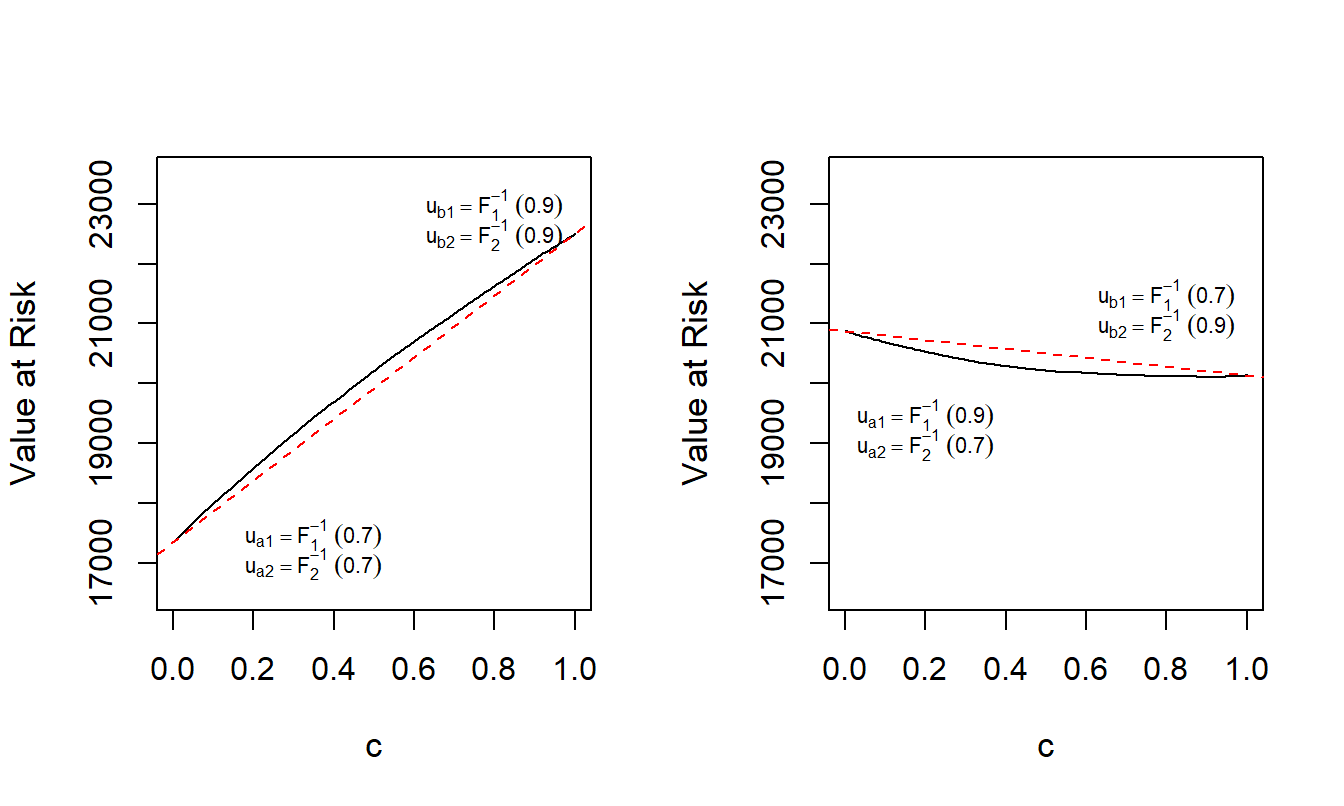

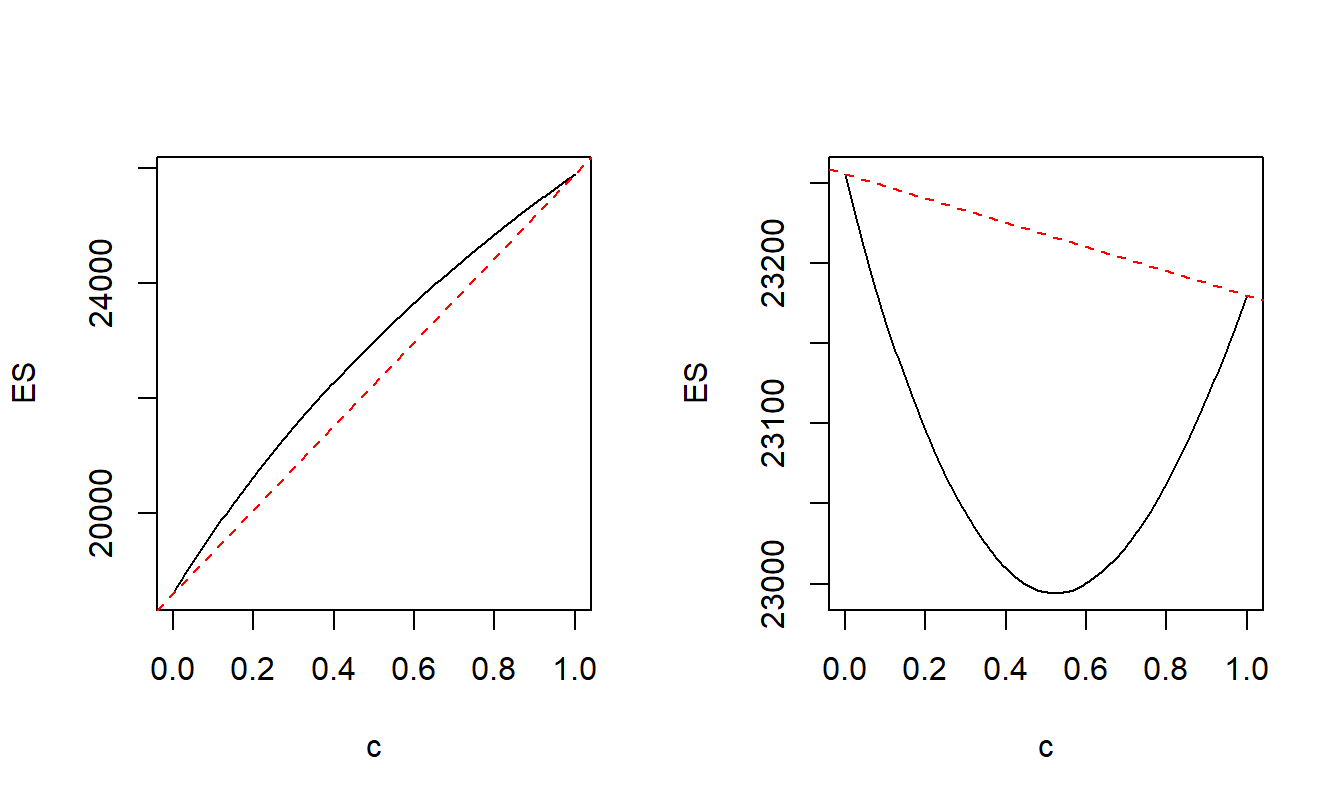

For the left-hand panel of Figure 5.1, define \({\bf u}_a =(F_1^{-1}(0.7),F_2^{-1}(0.7))\) and \({\bf u}_b =(F_1^{-1}(0.9),F_2^{-1}(0.9))\). Recall the notation that \(F_1^{-1}(0.7)\) denotes the 0.7 quantile of the first distribution (that turns out to be 12,196 for this example). This panel shows a plot of \(VaR_{0.9}[(1-c){\bf u}_a + c {\bf u}_b]\) versus \(c\); the linear interpolation \((1-c)VaR_{0.9}[{\bf u}_a]+ c VaR_{0.9}[{\bf u}_b]\) versus \(c\) is superimposed. Because the graph is above the linear interpolation, the \(VaR\) function is concave over this region.

For the right-hand panel of Figure 5.1, in the same way define \({\bf u}_a =(F_1^{-1}(0.9),F_2^{-1}(0.7))\) and \({\bf u}_b =(F_1^{-1}(0.7),F_2^{-1}(0.9))\). Because the graph is below the linear interpolation, the \(VaR\) function is convex over this region.

In sum, the value at risk function \(VaR_{0.9}({\bf u})\) is neither convex nor concave for all values of \({\bf u} =(u_1,u_2)\) meaning that we cannot use optimization methods that rely on the convexity of a function.

# Example 5.1 Set Up

risk1shape <- 2; risk1scale <- 5000

risk2shape <- 5 ; risk2scale <- 25000

rho <- -0.3

# Example 5.1 Illustrative Code

nsim <- 200000

set.seed(202020)

# Normal, or Gaussian, Copula

norm.cop <- copula::normalCopula(param=-0.3, dim = 2,'dispstr' ="un")

UCop <- copula::rCopula(nsim, norm.cop)

# Marginal Distributions

X1 <- qgamma(p=UCop[,1],shape = risk1shape, scale = risk1scale)

X2 <- actuar::qpareto(p=(UCop[,2]),shape = risk2shape, scale = risk2scale)

cVec <- seq(0, 1, length.out=200)

u1.0 <- qgamma(p=0.70,shape = risk1shape, scale = risk1scale)

u1.1 <- qgamma(p=0.90,shape = risk1shape, scale = risk1scale)

u2.0 <- actuar::qpareto(p=0.70,shape = risk2shape, scale = risk2scale)

u2.1 <- actuar::qpareto(p=0.90,shape = risk2shape, scale = risk2scale)

u1Vec.a <- u1.0*(1-cVec) + u1.1*cVec

u1Vec.b <- u1.1*(1-cVec) + u1.0*cVec

u2Vec <- u2.0*(1-cVec) + u2.1*cVec

# Objective Function

f0 <- function(u1,u2){

S <- pmin(X1,u1) + pmin(X2,u2)

return(quantile(S, probs=0.9))

}

VarVec.a <- 0* cVec -> VarVec.b

for (kindex in 1:length(cVec)) {

VarVec.a[kindex] <- f0(u1Vec.a[kindex],u2Vec[kindex])

VarVec.b[kindex] <- f0(u1Vec.b[kindex],u2Vec[kindex])

}

save(cVec,VarVec.a, VarVec.b,

file = "../ChapTablesData/Chap5/Example51.Rdata")

# Example 5.1 Illustrative Code, Figure 5.1

# save(cVec,VarVec.a, VarVec.b,

# file = "../ChapTablesData/Chap5/Example51.Rdata")

load(file = "ChapTablesData/Chap5/Example51.Rdata")

par(mfrow=c(1,2))

plot(cVec,VarVec.a, type = "l", ylab = "Value at Risk",

xlab = "c", ylim = c(16500,23500), cex.lab=1.1)

text(0.35, 17500, expression(u[a1]==F[1]^-1~(0.7)), cex = 0.7)

text(0.35, 17000, expression(u[a2]==F[2]^-1~(0.7)), cex = 0.7)

text(0.80, 23000, expression(u[b1]==F[1]^-1~(0.9)), cex = 0.7)

text(0.80, 22500, expression(u[b2]==F[2]^-1~(0.9)), cex = 0.7)

abline(a=VarVec.a[1],b=VarVec.a[length(cVec)]-VarVec.a[1],

lty = "dashed", col =FigRed)

plot(cVec,VarVec.b, type = "l", ylab = "Value at Risk",

xlab = "c", ylim = c(16500,23500), cex.lab=1.1)

text(0.20, 19500, expression(u[a1]==F[1]^-1~(0.9)), cex = 0.7)

text(0.20, 19000, expression(u[a2]==F[2]^-1~(0.7)), cex = 0.7)

text(0.80, 21500, expression(u[b1]==F[1]^-1~(0.7)), cex = 0.7)

text(0.80, 21000, expression(u[b2]==F[2]^-1~(0.9)), cex = 0.7)

abline(a=VarVec.b[1],b=VarVec.b[length(cVec)]-VarVec.b[1],

lty = "dashed", col =FigRed)

Our interest is in the convexity, or lack thereof, of summary measures of a retained risk. It is important to note that we are thinking of these as functions of risk retention parameters, not as functions of potential losses. That is, it is tempting to think of the realized excess of loss random variable, \(x_1 \wedge u_1 + x_2 \wedge u_2\), as a function of realized losses \(x_1\) and \(x_2\), as is common in applied statistics. In addition, both Examples 5.1 and 5.2 utilize continuous distributions (gamma and Pareto) for losses, mitigating discreteness issues when confirming convexity in the space of potential losses. However, because the interest is in optimization with respect to the risk retention parameter space, we specifically write the excess of loss random variable as \(S(u_1,u_2) =\) \(X_1 \wedge u_1 + X_2 \wedge u_2\) to emphasize our interest in retained loss distributions as a function of risk retention parameters.

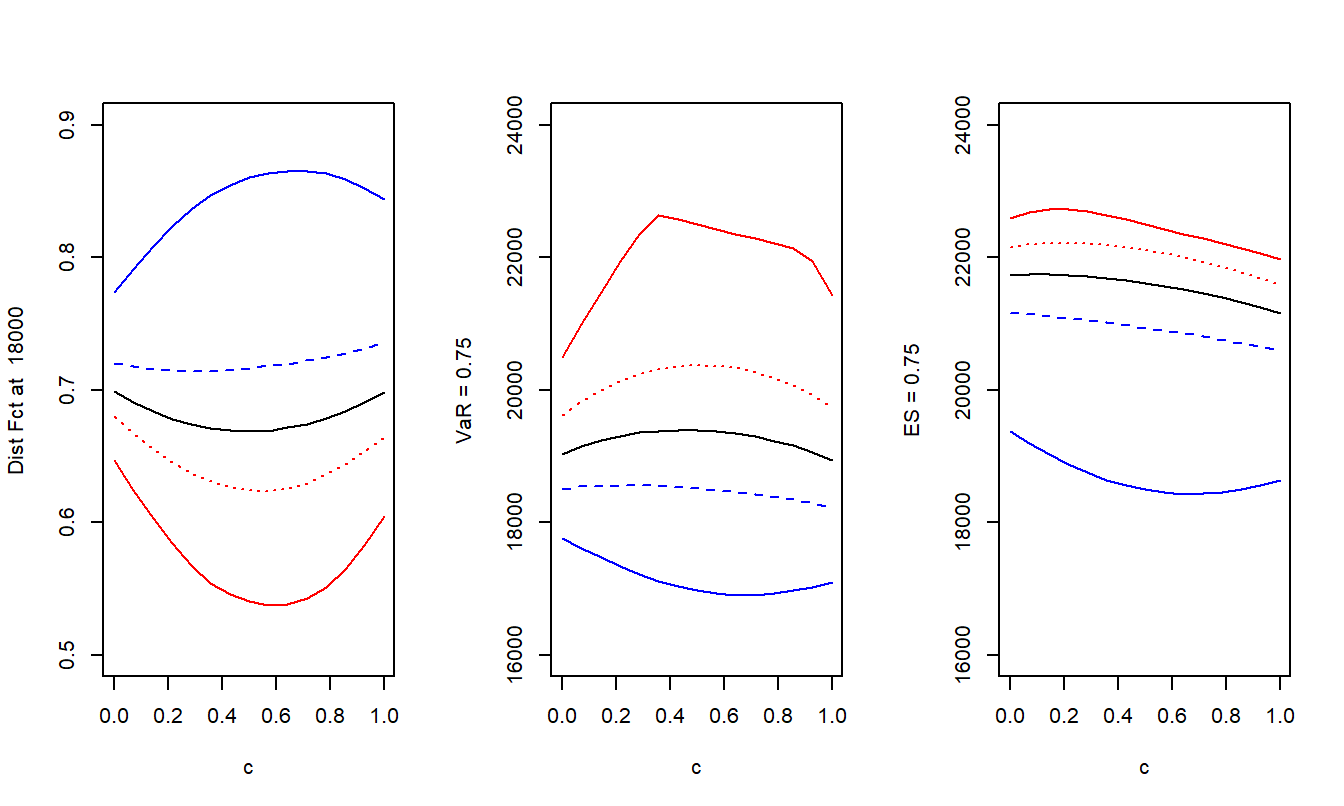

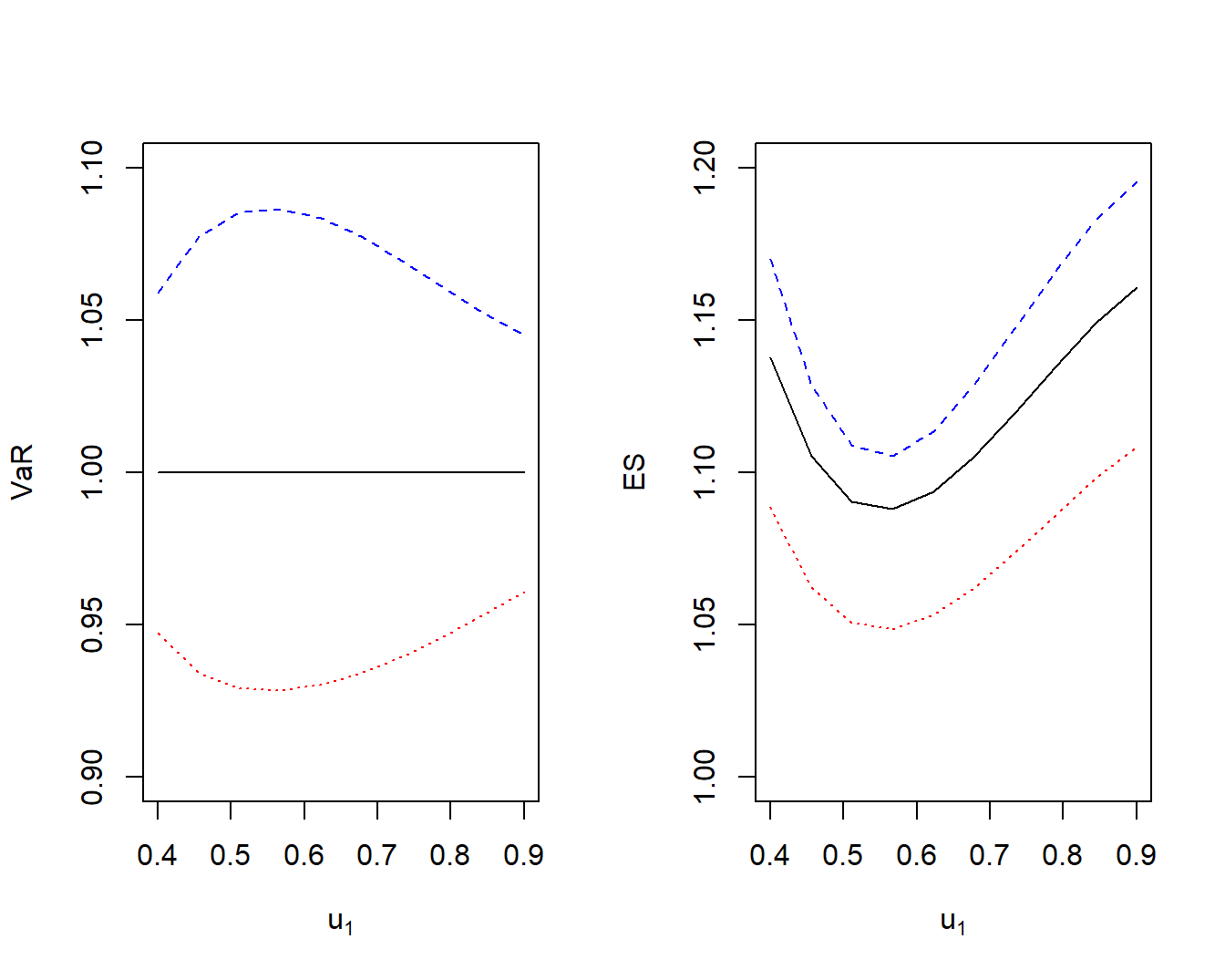

Example 5.2. Three Measures of Uncertainty. This example shows that each of the three measures of uncertainty (the distribution function, quantile, and \(ES\)) is neither convex nor concave for all values of dependence parameters.

To demonstrate this, assume that both \(X_1\) and \(X_2\) have gamma distributions with mean 10,000 and standard deviation 7,071. Their relationship is governed by a normal copula with parameter \(\rho\) that is allowed to vary.

We consider two points, \({\bf u}_a = (8000, 14000)\) and \({\bf u}_b = (16000, 7000)\) and evaluate the distribution function, quantile, and expected shortfall at convex combinations given by \(c {\bf u}_a + (1-c){\bf u}_b\). The distribution function is evaluated at 18,000 and the quantile and expected shortfall use \(\alpha = 0.75\).

Figure 5.2 shows that the convexity depends on the level of dependence. That is, for each measure, sometimes the function is convex and sometimes concave, depending on the dependence. Further, if you do not know about the dependence,

then you do not know whether the function that you are trying to optimize is convex or concave (or neither). As a consequence you may think you are maximizing a function and wind up minimizing it, or vice versa.

# Example 5.2 Set Up

risk1shape <- 2; risk1scale <- 5000

risk2shape <- 5 ; risk2scale <- 5000

# Example 5.2 Illustrative Code

nsim <- 200000

# set.seed(2018)

Q <- 18000

U1Vec <- c(8000, 14000)

U2Vec <- c(16000, 7000)

theta <- seq(from = 0, to = 1, length.out = 15)

uparam <- matrix(0,nrow=2,ncol=length(theta))

uparam[1,] <- U1Vec[1]*theta + U2Vec[1]*(1-theta)

uparam[2,] <- U1Vec[2]*theta + U2Vec[2]*(1-theta)

#uparam

alpha1 <- 0.75

rhoparam <- c(-0.9,-.3,0,0.3,0.9)

matrix(0,length(theta),length(rhoparam)) ->

yQ2 -> QuanS1 -> QuanS2

for (j in 1:length(rhoparam)) {

set.seed(2018)

copulaParam <- copula::iRho(normalCopula(param=1, dim = 2),

rho=rhoparam[j])

nc <- copula::normalCopula(param=copulaParam, dim = 2)

U <- copula::rCopula(nsim, nc)

risk1 <- q1(U[,1])

risk2 <- q1(U[,2])

for (i in 1:length(theta)) {

Retain <- pmin(risk1,uparam[1,i]) + pmin(risk2,uparam[2,i])

df.2 <- ecdf(Retain)

yQ2[i,j] <- df.2(Q)

quant <- quantile(Retain, probs = c(alpha1))

excess <- pmax(Retain-quant,0)

CTE <- quant + mean(excess)/(1-alpha1)

QuanS1[i,j] <- quant

QuanS2[i,j] <- CTE

}

}

save(theta,yQ2,QuanS1,QuanS2,Q,alpha1,

file = "../ChapTablesData/Chap5/Example52.Rdata")

# Example 5.2 Illustrative Code, Figure 5.2

# save(theta,yQ2,QuanS1,QuanS2,

# file = "../ChapTablesData/Chap5/Example52.Rdata")

load(file = "ChapTablesData/Chap5/Example52.Rdata")

par(mfrow = c(1,3))

plot(theta,yQ2[,3], type = "l", ylab=paste("Dist Fct at ",Q),

ylim=c(0.5,0.9), xlab = "c")

lines(theta,yQ2[,4], col=FigRed, lty=3)

lines(theta,yQ2[,2], col=FigBlue, lty=2)

lines(theta,yQ2[,5], col=FigRed, lty=1)

lines(theta,yQ2[,1], col=FigBlue, lty=1)

plot(theta,QuanS1[,3], type = "l", ylab=paste("VaR =",alpha1),

xlab = "c", ylim = c(16000,24000))

lines(theta,QuanS1[,4], col=FigRed, lty=3)

lines(theta,QuanS1[,2], col=FigBlue, lty=2)

lines(theta,QuanS1[,5], col=FigRed, lty=1)

lines(theta,QuanS1[,1], col=FigBlue, lty=1)

plot(theta,QuanS2[,3], type = "l", ylab=paste("ES =",alpha1),

xlab = "c", ylim = c(16000,24000))

lines(theta,QuanS2[,4], col=FigRed, lty=3)

lines(theta,QuanS2[,2], col=FigBlue, lty=2)

lines(theta,QuanS2[,5], col=FigRed, lty=1)

lines(theta,QuanS2[,1], col=FigBlue, lty=1)

Excess of Loss Distribution

In the bivariate case, there are two risks \(X_1, X_2\). For \(j=1,2\), the distribution of \(X_j\) is \(F_j\) and, when available, the density function is denoted as \(f_j\). The excess of loss retained risk function is \(g(X_1,X_2; \boldsymbol \theta)=\) \(X_1 \wedge u_1 + X_2 \wedge u_2\). For simplicity, this chapter uses the limited sum expression \(S(u_1,u_2) = X_1 \wedge u_1 + X_2 \wedge u_2\) for retained risks.

Distribution Function and Quantiles

Distribution Function. In some detail, I develop the distribution function of \(S(u_1,u_2)\) that can be evaluated at a generic \(y\). First note that if \(y \ge u_1+u_2\), then \(\Pr[S(u_1,u_2) \le y] =1\). So, now consider the case where \(y < u_1+u_2\). On this set, one has

\[\begin{equation}

\begin{array}{ll}

\Pr[S(u_1,&u_2) \le y] \\ ~\\

&= \int_0^{F_1(u_1)} \int_0^{F_2(u_2)} I[F_1^{-1}(z_1) + F_2^{-1}(z_2) \le y]~ c(z_1, z_2) ~ dz_2 dz_1 \\

& \ \ \ + F_2(y-u_1) - C[F_1(u_1),F_2(y-u_1)] \\

& \ \ \ + F_1(y - u_2) - C[F_1(y - u_2),F_2(u_2)] \\ \\

&= \int^{u_1}_{-\infty} C_1[F_1(x), F_2(\min(y-x, u_2))] ~ f_1(x)dx \\

& \ \ \ + F_2(y-u_1) - C[F_1(u_1),F_2(y-u_1)] \\

& \ \ \ + F_1(y - u_2) - C[F_1(y - u_2),F_2(u_2)] .\\

\end{array}

\tag{5.1}

\end{equation}\]

The partial derivative of the copula distribution function, \(C_1(u,v) =\partial_u C(u,v)\), is described in more detail in Appendix Chapter 14. Equation (5.1) is valid for random variables with a domain on the entire real line. Note that if \(X_1\) has a domain on the non-negative portion of the real line and \(u_2>y\), then \(F_1(y-u_2) = 0\), and similarly for \(X_2\). This observation can simplify the calculation.

Going back to the basics, we partition the distribution using the following four sets:

\[

\begin{array}{lcl}

A_1 = \{ X_1 > u_1, X_2 > u_2\}& &

A_2 = \{ X_1 \le u_1, X_2 > u_2\} \\

A_3 = \{ X_1 > u_1, X_2 \le u_2\}& &

A_4 = \{ X_1 \le u_1, X_2 \le u_2\}. \\

\end{array}

\]

At a generic \(y\),or the first set, we have

\[

\begin{array}{ll}

\Pr(S \le y, A_1) &= \Pr(X_1 \wedge u_1 + X_2 \wedge u_2 \le y, X_1 > u_1, X_2 > u_2) \\

&= \Pr(u_1 + u_2 \le y, X_1 > u_1, X_2 > u_2) = I(u_1 + u_2 \le y) \Pr(A_1) \\

&= 0,

\end{array}

\]

because we exclude the case where \(u_1+u_2 \le y\).

For the second set,

\[

\begin{array}{ll}

& \Pr(S \le y, A_2) \\

&= \Pr(X_1 \wedge u_1 + X_2 \wedge u_2 \le y, X_1 \le u_1, X_2 > u_2) \\

&= \Pr(X_1 + u_2 \le y, X_1 \le u_1, X_2 > u_2) =\Pr(X_1 \le y - u_2, X_1 \le u_1, X_2 > u_2)\\

&= \Pr(X_1 \le \min(y-u_2, u_1), X_2 > u_2) = \Pr(X_1 \le y-u_2, X_2 > u_2) \\

&= \Pr(X_1 \le y-u_2) - \Pr(X_1 \le y-u_2, X_2 \le u_2) \\

&= F_1(y-u_2) - C[F_1(y-u_2), F_2(u_2)],

\end{array}

\]

using copula notation. The third line is because \(u_1+u_2 > y\) implies \(\min(y-u_2, u_1) = y-u_2\).

In the same way, for the third set we have

\[

\Pr(S \le y, A_3) = \Pr(X_2 \le y-u_1, X_1 > u_1) =F_2(y-u_1) - C[F_1(u_1),F_2(y-u_1)].

\]

For the fourth set,

\[

\begin{array}{ll}

\Pr(S \le y, A_4) &= \Pr(X_1 \wedge u_1 + X_2 \wedge u_2 \le y, X_1 \le u_1, X_2 \le u_2) \\

&= \Pr(X_1 + X_2 \le y, X_1 \le u_1, X_2 \le u_2) \\

&= \int^{u_1}_{-\infty} \int^{u_2}_{-\infty} I[x_1 + x_2 \le y]f(x_1,x_2)dx_1dx_2 \\

&= \int_0^{F_1(u_1)} \int_0^{F_2(u_2)} I[F_1^{-1}(z_1) + F_2^{-1}(z_2) \le y] c(z_1, z_2) ~ dz_2 dz_1 .

\end{array}

\]

This is sufficient for equation (5.1). For calculation purposes, we also use

\[

\begin{array}{ll}

\Pr(S \le y, A_4) &= \Pr(X_1 + X_2 \le y, X_1 \le u_1, X_2 \le u_2) \\

&= \int^{u_1}_{-\infty} \Pr(X_2 \le y-x, X_2 \le u_2|X_1 = x) f_1(x)dx \\

&= \int^{u_1}_{-\infty} \Pr(X_2 \le \min(y-x, u_2) |X_1 = x) f_1(x)dx \\

&= \int^{u_1}_{-\infty} C_1[F_1(x), F_2(\min(y-x, u_2)] f_1(x)dx ,\\

\end{array}

\]

using the relation

\[

\begin{array}{ll}

\Pr(X_2 \le z |X_1 = x)

&= \frac{\partial_x \Pr(X_2 \le z , X_1 \le x)}{f_1(x)}= \frac{\partial_x C[F_1(x),F_2(z)]}{f_1(x)} \\

&= C_1[F_1(x),F_2(z)] .

\end{array}

\]

See Appendix Chapter 13 for a discussion of derivatives and conditional distributions with copulas.

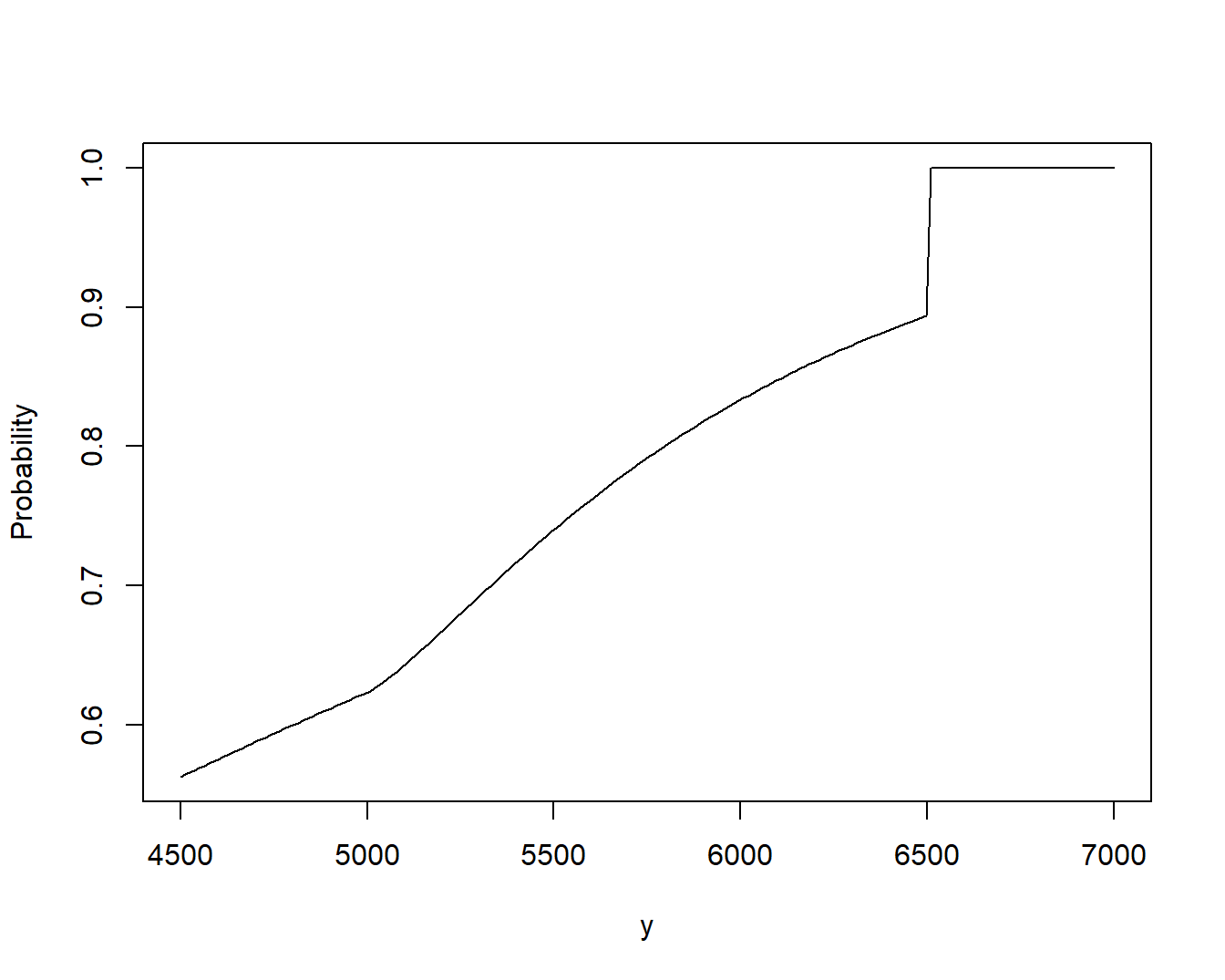

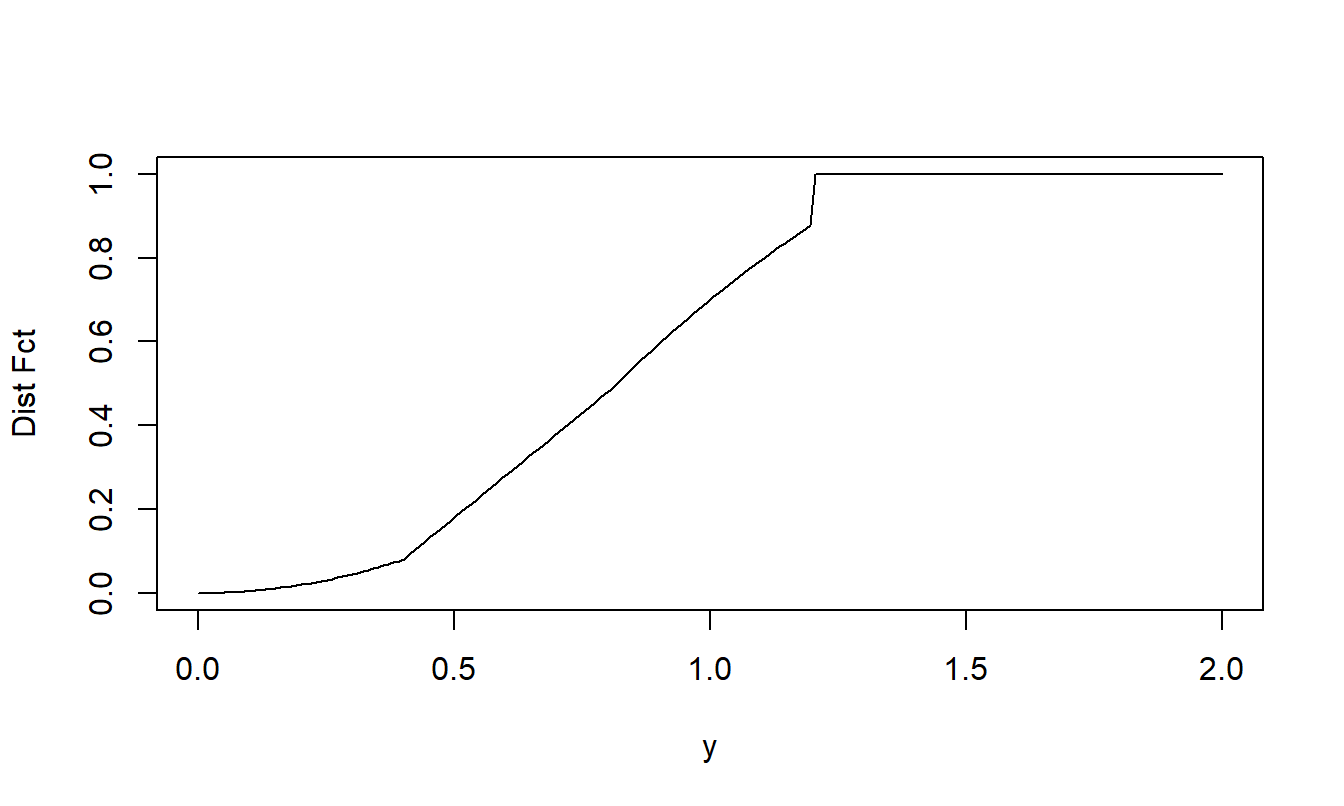

Example 5.3. Bivariate Excess of Loss Distribution. To show the flexibility of this set-up, we use different distributions for the two risks. Specifically, assume that \(X_1\) has a gamma distribution with shape parameter 2 and scale parameter 2,000 and that \(X_2\) has a Pareto distribution with shape parameter 3 and scale parameter 2,000. Their relationship is governed by a normal copula with parameter \(\rho = 0.5\). The code uses \(u_1 = 5,000\) and \(u_2 =1,500\).

Illustrative code shows how to determine the distribution function in two ways, one via integration following the formula in equation (5.1) and one via simulation. Figure 5.3 summarizes the excess of loss distribution function. Even though the two random variables are continuous, note the point of discreteness at \(y=6,500\) where the jump in the distribution function occurs.

# Example 5.3 Set Up

risk1shape <- 2; risk1scale <- 2000

risk2shape <- 3 ; risk2scale <- 2000

# These functions are used throughout the book, beginning in Chap 1

# Basic Summary Functions for a gamma Distribution

f1 <- function(x){dgamma(x=x,shape = risk1shape, scale = risk1scale)}

F1 <- function(x){pgamma(q=x,shape = risk1shape, scale = risk1scale)}

q1 <- function(x){qgamma(p=x,shape = risk1shape, scale = risk1scale)}

ERisk1fun <- function(){actuar::mgamma(order=1, shape = risk1shape,

scale = risk1scale)}

sdRisk1fun <- function(){

sqrt(actuar::mgamma(order=2, shape = risk1shape,

scale = risk1scale) - ERisk1fun()**2)}

RC1 <- function(u){

ERisk1fun() - actuar::levgamma(limit = u, shape = risk1shape,

scale = risk1scale)}

# Basic Summary Functions for a Pareto Distribution

f2 <- function(x){actuar::dpareto(x=x,shape = risk2shape, scale = risk2scale)}

F2 <- function(x){actuar::ppareto(q=x,shape = risk2shape, scale = risk2scale)}

q2 <- function(x){actuar::qpareto(p=x,shape = risk2shape, scale = risk2scale)}

ERisk2fun <- function(){actuar::mpareto(order=1, shape = risk2shape,

scale = risk2scale)}

sdRisk2fun <- function(){

sqrt(actuar::mpareto(order=2, shape = risk2shape,

scale = risk2scale) - ERisk2fun()**2)}

RC2 <- function(u){

ERisk2fun() - actuar::levpareto(limit = u,shape = risk2shape,

scale = risk2scale)}

# Additive Risk Transfer Cost

RTC <- function(u1,u2){ RC1(u1)+RC2(u2) }

# Chapter 5 Gamma Pareto Functions

Prob.fct <- function(u1,u2,rho,y){

u1 <- u1*(u1>0)

u2 <- u2*(u2>0)

norm.cop <- copula::normalCopula(param=rho, dim = 2,'dispstr' ="un")

ProbA <- 0 -> ProbB -> ProbC -> ProbD1 -> ProbD2

if (y>u1) { ProbB <- F2(y-u1) - pCopula(c(F1(u1),F2(y-u1)), norm.cop) }

if (y>u2) { ProbC <- F1(y-u2) - pCopula(c(F1(y-u2),F2(u2)), norm.cop) }

ProbD1.x <- function(x){VineCopula::BiCopHfunc1(F1(x),F2(y-x),

family=1, par=rho)*f1(x)}

ProbD1.x.vec <- Vectorize(ProbD1.x)

ProbD1 <- cubature::cubintegrate(ProbD1.x.vec,

lower = max(0,y-u2), upper = min(y,u1),

relTol =1e-4, absTol =1e-8,

method = "hcubature")$integral

if (y>u2) { ProbD2 <- copula::pCopula(c(F1(y-u2),F2(u2)), norm.cop) }

ProbTot <- ProbA + ProbB + ProbC + ProbD1 + ProbD2

ProbTot <- ProbTot + (1-ProbTot)*(u1+u2<y)

ProbTot <- ProbTot*(y>0)

return(ProbTot)

}

ExLossESGamPareto <- function(u1,u2,rho,alpha){

Prob.alpha <- function(y){3e5*(Prob.fct(u1,u2,rho,y) - alpha)}

VaR <- uniroot(Prob.alpha, lower = 0, upper = 10e6)$root

Surv.fct.y <- function(y){1-Prob.fct(u1,u2,rho,y)}

Surv.fct.y.vec <- Vectorize(Surv.fct.y)

Sum.limited.Var <- integrate(Surv.fct.y.vec, lower = 0,

upper = VaR)$value

TotalRetained <- actuar::levgamma(limit = u1,shape = risk1shape,

scale = risk1scale) +

actuar::levpareto(limit = u2,shape = risk2shape,

scale = risk2scale)

ES <- VaR + (TotalRetained- Sum.limited.Var)/(1-alpha)

Output <- list(Prob.fct(u1,u2,rho, y=4.5*RTCmax), VaR, ES)

return(Output)

}

# Example 5.3 Illustrative Code, Figure 5.3

# No Constraints

# Determine the Probability

u1<-5000;u2 <- 1500; rho<-0.5;

Probsumarg <- seq(max(u1,u2)-500, u1+u2+500, length.out=200)

Probsum <- 0*Probsumarg

for (kindex in 1:length(Probsumarg)) {

Probsum[kindex] <- Prob.fct(u1,u2,rho, Probsumarg[kindex]) }

plot(Probsumarg,Probsum, type="l", ylab="Probability", xlab="y" )

# Example 5.3 Illustrative Code

# Check Using Simulation

nsim <- 1000000

rGaus <- matrix(rnorm(2*nsim),nrow=nsim,ncol=2)

rho <- 0.5

Sigma.11 <- matrix(c(1,rho,rho,1),nrow=2,ncol=2)

rGaus.new <- rGaus %*% chol(Sigma.11)

UCop1 <- pnorm(rGaus.new[,1])

UCop2 <- pnorm(rGaus.new[,2])

# Marginal Distribution Random variables

X1 <- qgamma(p=UCop1,shape = risk1shape, scale = risk1scale)

X2 <- actuar::qpareto(p=UCop2,shape = risk2shape,

scale = risk2scale)

S <- pmin(X1,u1) + pmin(X2,u2)

# Checks out well

# mean((S <= 6000))

# Prob.fct(u1,u2,rho, 6000)

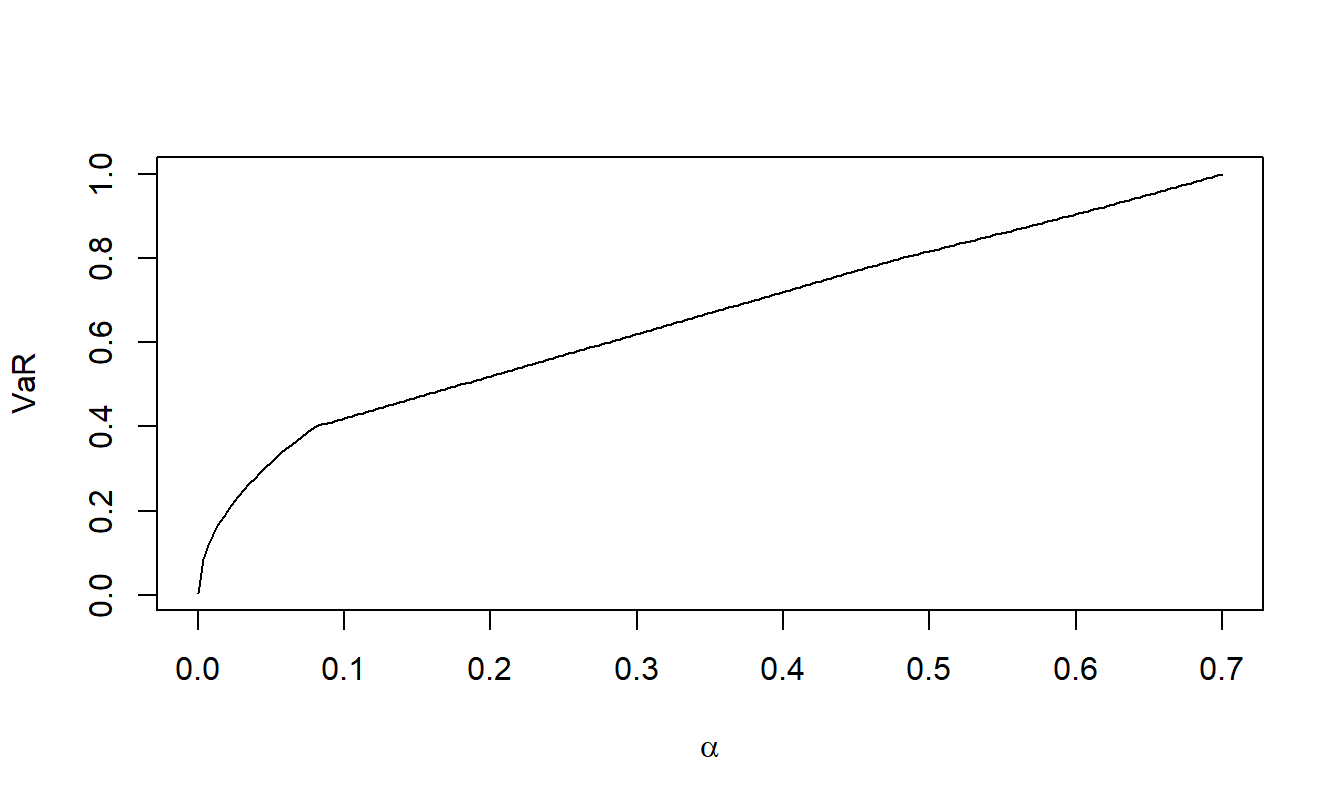

Quantiles. The R code shows how to determine quantiles (value at risk) for the excess of loss distribution in three ways:

- using the formula in equation (5.1) with the

R uniroot function,

- via simulation, and

- as a constrained optimization approach that will be presented in Section 7.2.

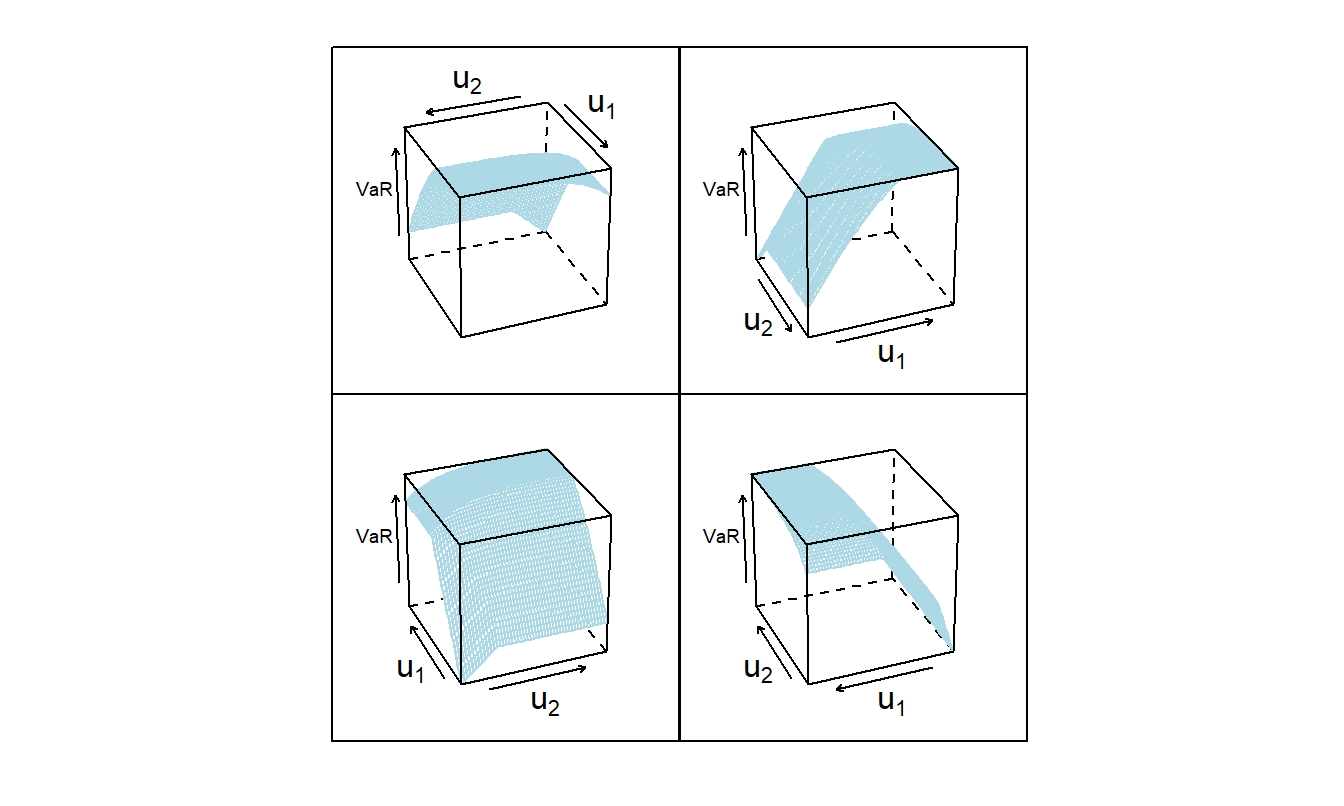

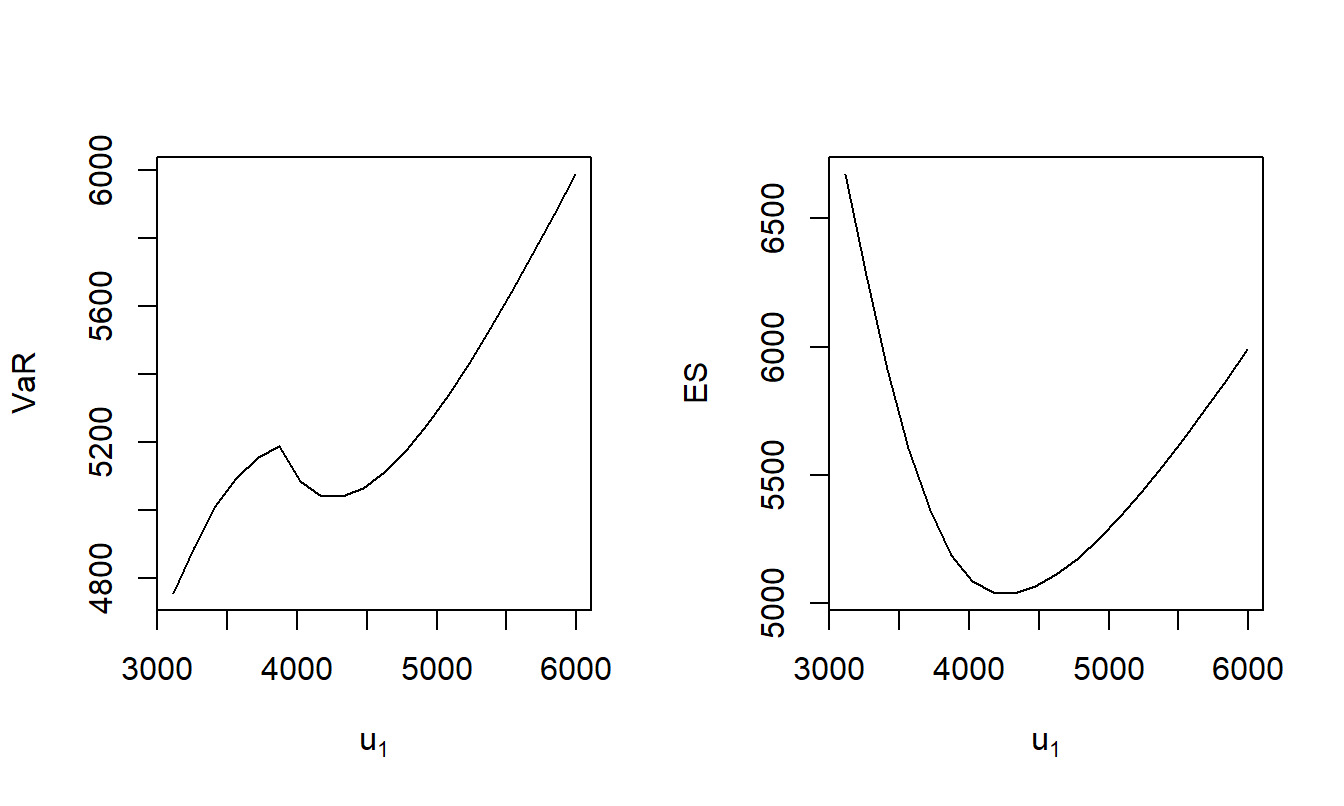

I use the distribution and parameter values from Example 5.3 and \(\alpha = 0.85\). It turns out that the quantile is approximately 6,116. Figure 5.4 summarizes the quantile as a function of the two upper limits with a three-dimensional figure, shown from several perspectives.

# Example 5.3 Illustrative Code

# Determine the Quantile

u1 <- 5000; u2 <- 1500; rho <- 0.5; alpha <- 0.85;

Prob.alpha <- function(Quan){Prob.fct(u1,u2,rho,Quan) - alpha}

QuanAlpha <- uniroot(Prob.alpha, lower = 0, upper = 10e6)$root

# Simulation

#QuanAlphasim <- quantile(S, probs = alpha, na.rm = TRUE)

# Constrained Optimization Approach

y.Vec <- function(par){par[1]}

Prob.y.Vec <- function(par){

y=par[1]

return(1e6*(Prob.fct(u1,u2,rho,y) - alpha))

}

f0Prob.opt <-

auglag(par=7000, # initial value

fn=y.Vec, # objective function

hin=Prob.y.Vec, # inequality constraint

control.outer=list(method="nlminb",trace=FALSE, itmax=20),

control.optim=list(maxit=20))

#QuanAlpha;QuanAlphasim;f0Prob.opt$value

# Nice

# Example 5.3 Set Up

risk1shape <- 2; risk1scale <- 2000

risk2shape <- 3 ; risk2scale <- 2000

# Example 5.3 Illustrative Code

# This code generates the VaR and ES over a grid of values of u1 and u2

# Done for corr = 0.5 and corr = -0.5

# Results are stored in and .RData file for later use....

TimeNeg <- Sys.time()

alpha <- 0.85

rho <- 0.50

gridsize <- 50

u1Vec <-

seq(qgamma(p=0.01,shape = risk1shape, scale = risk1scale),

qgamma(p=0.99,shape = risk1shape, scale = risk1scale),

length.out=gridsize)

u2Vec <-

seq(actuar::qpareto(p=0.01,shape = risk2shape, scale = risk2scale),

actuar::qpareto(p=0.99,shape = risk2shape, scale = risk2scale),

length.out=gridsize)

RMGridPos <- matrix(0,gridsize**2,5)

count = 0

for (i in 1:gridsize)

{for (j in 1:gridsize) {

count = count + 1

RMGridPos[count,1] <- u1Vec[i]

RMGridPos[count,2] <- u2Vec[j]

T1 <- ExLossESGamPareto(u1=u1Vec[i],u2=u2Vec[j],rho,alpha)

RMGridPos[count,3] <- T1[[2]]

RMGridPos[count,4] <- T1[[3]]

RMGridPos[count,5] <- RC1(u1Vec[i]) + RC2(u2Vec[j])

}}

colnames(RMGridPos) <- c("u1", "u2", "VaR", "ES", "RTC")

RMGridPos <- data.frame(RMGridPos)

save(RMGridPos,

file = "../ChapTablesData/Chap5/Example521PosCorr.RData")

#Rerun with negative correlation

TimeNeg <- Sys.time()

rho <- -0.5;

RMGridNeg <- matrix(0,gridsize**2,5)

count <- 0

for (i in 1:gridsize)

{for (j in 1:gridsize) {

count <- count + 1

RMGridNeg[count,1] <- u1Vec[i]

RMGridNeg[count,2] <- u2Vec[j]

T1 <- ExLossESGamPareto(u1=u1Vec[i],u2=u2Vec[j],rho,alpha)

RMGridNeg[count,3] <- T1[[2]]

RMGridNeg[count,4] <- T1[[3]]

RMGridNeg[count,5] <- RC1(u1Vec[i]) + RC2(u2Vec[j])

}}

colnames(RMGridNeg) <- c("u1", "u2", "VaR", "ES", "RTC")

RMGridNeg <- data.frame(RMGridNeg)

save(RMGridNeg,

file = "../ChapTablesData/Chap5/Example521NegCorr.RData")

Sys.time() - TimeNeg

#Time difference of 3.11391334 hours

# Example 5.3 Illustrative Code, Figure 5.4

# save(RMGridPos,

# file = "../ChapTablesData/Chap5/Example521PosCorr.RData")

load( file = "ChapTablesData/Chap5/Example521PosCorr.RData")

angle <- 22+c(0, 90, 180,270)

#angle <- c( 160, 240, 110, 20)

Angle <- shingle(rep(angle, rep(length(RMGridPos[,3]), 4)),angle)

wireframe(rep(RMGridPos[,3], 4) ~

rep(RMGridPos[,2], 4) *rep(RMGridPos[,1], 4) | Angle,

groups = Angle,

panel = function(x, y, subscripts, z, groups,...){

w <- groups[subscripts][1]

panel.wireframe(x, y, subscripts, z,

screen = list(z = w, x = -60, y = 0), ...)},

strip = FALSE,

par.settings = list(par.zlab.text=list(cex = 0.6)),

skip = c(F, F, F, F),

layout = c(2,2),#shade=TRUE,

distance = 0.1, col = FigLBlue,

xlab = expression(u[2]), ylab = expression(u[1]),

zlab = "VaR")

Partial Derivatives of Distribution Functions

Partial Derivatives of the Distribution Function. I next develop partial derivatives of the distribution function. Based on equation (5.1), one can establish

\[\begin{equation}

\begin{array}{ll}

\partial_{u_1} &\Pr[S(u_1,u_2) \le y] \\

& = - f_2(y-u_1)\left\{1-C_2[F_1(u_1),F_2(y-u_1)] \right\} .\\

\end{array}

\tag{5.2}

\end{equation}\]

Taking a partial derivative of the first line of equation (5.1), we have

\[

\begin{array}{ll}

\frac{\partial}{\partial u_1} & \int_0^{F_1(u_1)} \int_0^{F_2(u_2)} I[F_1^{-1}(z_1) + F_2^{-1}(z_2) \le y] c(z_1, z_2) ~ dz_2 dz_1 \\

& = f_1(u_1)\int_0^{F_2(u_2)} I[u_1 + F_2^{-1}(z_2) \le y] ~c[F_1(u_1), z_2] ~ dz_2 \\

& = f_1(u_1)\int_0^{F_2(u_2)\wedge F_2(y-u_1)} c[F_1(u_1), z_2] ~ dz_2 \\

& = f_1(u_1) ~C_1[F_1(u_1), F_2(y-u_1)] ,\\

\end{array}

\]

with \(y-u_1 < u_2\).

Taking a partial derivative of the second line of equation (5.1) yields

\[

\begin{array}{ll}

\partial_{u_1}& \left\{F_2(y-u_1) - C[F_1(u_1),F_2(y-u_1)] \right\} \\

& = -f_2(y - u_1) - \partial_{u_1} \left\{C[F_1(u_1),F_2(y-u_1)]\right\} \\

& = -f_2(y - u_1) \\

& \ \ \ \ - \left\{f_1(u_1)C_1[F_1(u_1),F_2(y-u_1)]-f_2(y-u_1)C_2[F_1(u_1),F_2(y-u_1)]\right\} \\

& = - f_1(u_1) C_1[F_1(u_1), F_2(y-u_1)]-f_2(y-u_1)\left\{1-C_2[F_1(u_1),F_2(y-u_1)] \right\} .\\

\end{array}

\]

Adding these two results is sufficient for equation (5.2).

Note that this partial derivative is 0 for \(u_1>y\) and non-negative \(X_2\). Intuitively, for large upper limits \(u_1\), changes in \(u_1\) do not affect the distribution function. Now, in the same way,

\[\begin{equation}

\begin{array}{ll}

\partial_{u_2} & \Pr[S(u_1,u_2) \le y] \\

& = - f_1(y-u_2) \left\{1-C_2[F_2(u_2),F_1(y-u_2)] \right\} .\\

\end{array}

\tag{5.3}

\end{equation}\]

This presentation assumes a copula symmetric in its arguments so that \(C(u_1,u_2)=C(u_2,u_1)\). For symmetric copulas, one has

\[

C_1(u_1,u_2)=\partial_{u_1}C(u_1,u_2)=\partial_{u_1}C(u_2,u_1)=C_2(u_2,u_1).

\]

This assumption serves to ease some of the computational aspects, as follows.

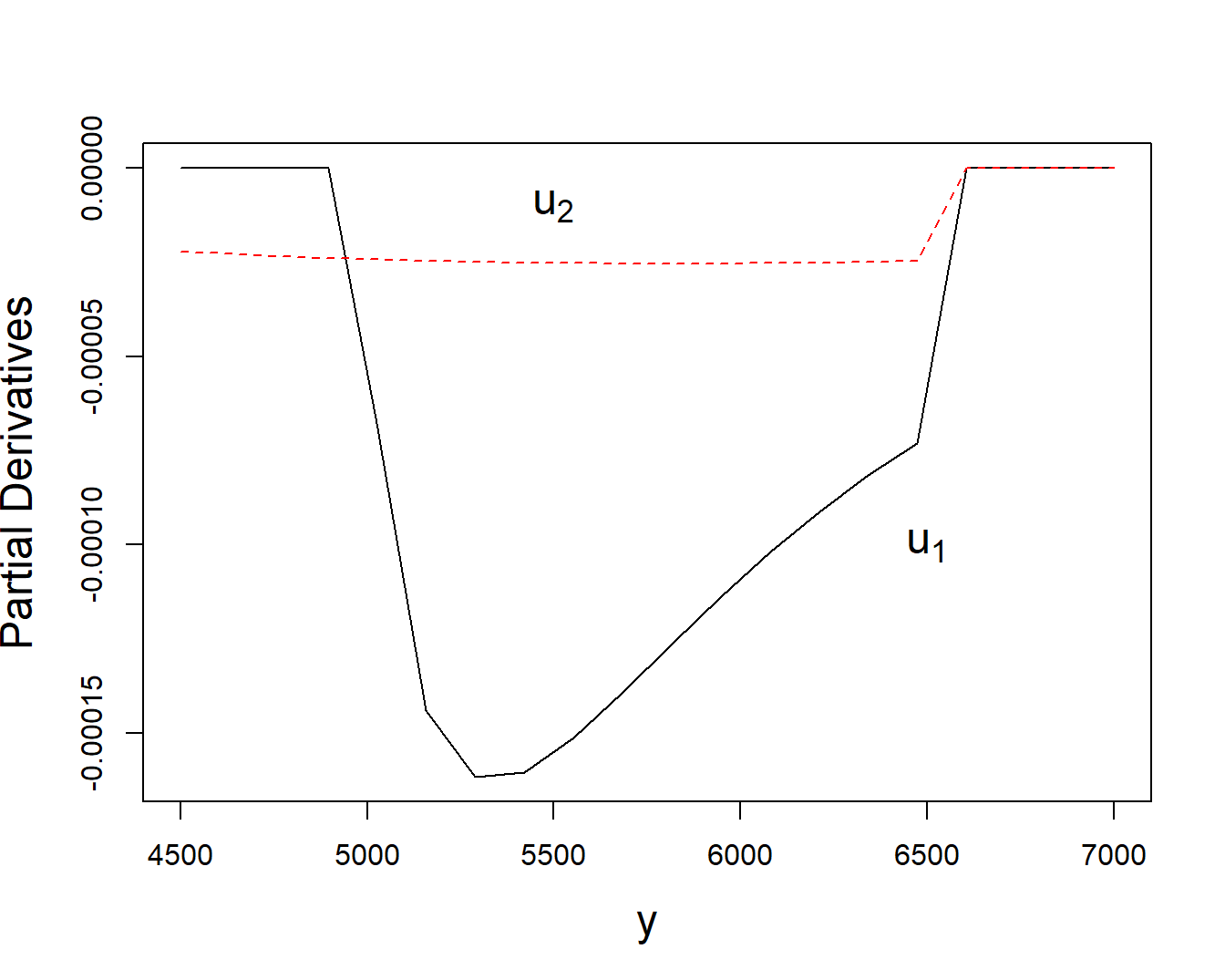

Example 5.4. Partial Derivatives of Bivariate Excess of Loss Distribution Function. This is a continuation of Example 5.3. To illustrate, a block of code is available that shows how to evaluate the partial derivatives. The resulting values are corroborated using numerical approximations from the R function grad. Using the distribution and parameter values from Example 5.3 and \(\alpha = 0.85\), Figure 5.5 summarizes the behavior of these partial derivatives.

# Example 5.4 Illustrative Code

# No Constraints

PDeriv.fct <- function(u1,u2,rho,y){

u1 <- u1*(u1>0)

u2 <- u2*(u2>0)

norm.cop <- copula::normalCopula(param=rho, dim = 2,'dispstr' ="un")

PDeriv.u1 <- -((u1<y)*f2(y-u1)*(1 -

VineCopula::BiCopHfunc2(F1(u1),F2(y-u1), family=1, par=rho)) )*(u1+u2>y)

PDeriv.u2 <- -((u2<y)*f1(y-u2)*(1 -

VineCopula::BiCopHfunc2(F2(u2),F1(y-u2), family=1, par=rho)) )*(u1+u2>y)

return(c(PDeriv.u1,PDeriv.u2))

}

# Plot the Partial Derivatives

u1 <- 5000;u2 <- 1500; rho <- 0.5;

PDeriv.arg <- seq(max(u1,u2)-500, u1+u2+500, length.out=20)

PDeriv.u1 <- 0*PDeriv.arg -> PDeriv.u2

for (kindex in 1:length(PDeriv.arg)) {

PDeriv.u1[kindex] <- PDeriv.fct(u1,u2,rho, PDeriv.arg[kindex])[1]

PDeriv.u2[kindex] <- PDeriv.fct(u1,u2,rho, PDeriv.arg[kindex])[2]

}

plot(PDeriv.arg,PDeriv.u1, type="l",

ylab="Partial Derivatives", xlab="y", cex.lab=1.5 )

lines(PDeriv.arg, PDeriv.u2, col = FigRed , lty =2)

text(6500,-0.00010, expression(u[1]), cex=1.5)

text(5500,-0.00001, expression(u[2]), cex=1.5)

# Determine the Partial Derivative Using Numerical Approximation

Prob.fct.Vec <- function(par,rho){Prob.fct(par[1],par[2],par[3],par[4])}

# Agreement in these two approaches

#numDeriv::grad(f=Prob.fct.Test.Vec, x = c(5000,1500))

# numDeriv::grad(f=Prob.fct.Vec, x = c(5000,1500,0.5,6000))

# PDeriv.fct(5000,1500,0.5,6000)

Second-Order Partial Derivatives of the Distribution Function. Note that the partial derivatives in equations (5.2) and (5.3) are functions of a single upper limit, so the derivative with respect to both parameters is zero. One can also determine

\[\begin{equation}

{\small

\begin{array}{lll}

& \partial^2_{u_1} \Pr[S(u_1,u_2) \le y] \\

& = -\partial_{u_1} \left[f_2(y-u_1)\left\{1-C_2[F_1(u_1),F_2(y-u_1)] \right\} \right]\\

& = \left[f_2^{\prime}(y-u_1)\left\{1-C_2[F_1(u_1),F_2(y-u_1)] \right\} \right.\\

& \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ + f_2(y-u_1)\{c[F_1(u_1),F_2(y-u_1)]f_1(u_1) \\

& \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \left. -C_{22}[F_1(u_1),F_2(y-u_1)]f_2(y-u_1)\} \right] .\\

\end{array}

}

\tag{5.4}

\end{equation}\]

Switch the indices to get an expression for \(\frac{\partial^2}{\partial u_2^2} \Pr[S(u_1,u_2) \le y]\).

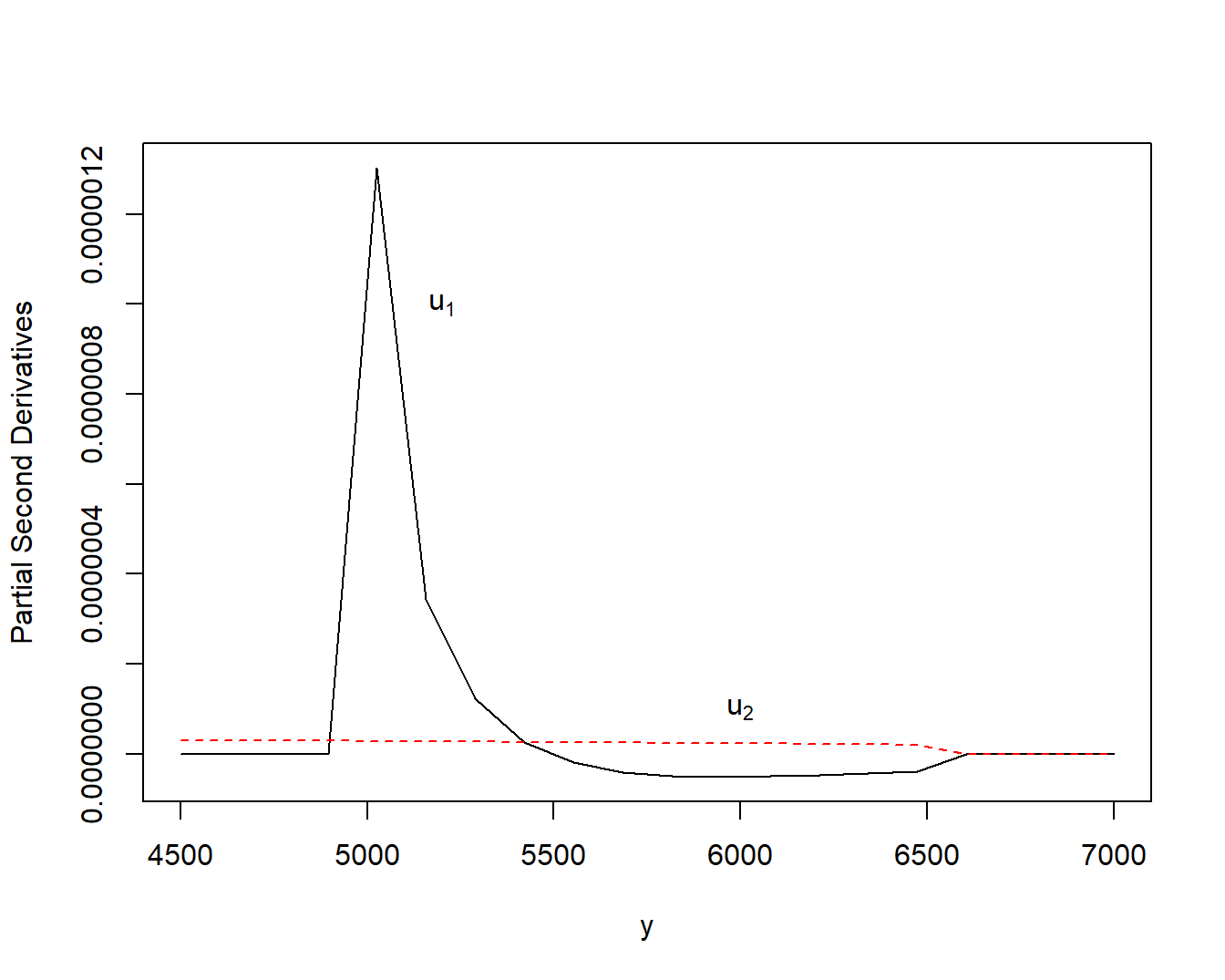

Example 5.5. Second Partial Derivatives of Bivariate Excess of Loss Distribution Function. This is a continuation of Example 5.4. To illustrate, a block of code is available that shows how to evaluate the partial second derivatives. The resulting values are corroborated using numerical approximations from the R functions grad and hessian. Using the distribution and parameter values from Example 5.3 and \(\alpha = 0.85\), Figure 5.6 shows the behavior of these partial second derivatives.

# Example 5.5 Illustrative Code

f2prime <- function(y){-f2(y)*(risk2shape+1)/(y+risk2scale) }

f1prime <- function(y){

( (risk1shape-1)/y - 1/risk1scale )*f1(y)

}

C22 <- function(v1,v2,rho){

z1 <- qnorm(v1)

z2 <- qnorm(v2)

arg <- (z1 - rho*z2)/sqrt(1 - rho*rho)

C22.v1v2 <- - rho/(sqrt(1 - rho*rho)*dnorm(z2))*dnorm(arg)

return(C22.v1v2)

}

PSecDeriv.fct <- function(u1,u2,rho,y){

u1 <- u1*(u1>0)

u2 <- u2*(u2>0)

norm.cop <- copula::normalCopula(param=rho, dim = 2,'dispstr' ="un")

PSecDeriv.u1 <- f2prime(y-u1)*(1 -

VineCopula::BiCopHfunc2(F1(u1),F2(y-u1), family=1, par=rho) ) +

f2(y-u1)*dCopula(c(F1(u1),F2(y-u1)), norm.cop)*f1(u1) -

f2(y-u1)*C22(F1(u1),F2(y-u1),rho)*f2(y-u1)

PSecDeriv.u1 <- PSecDeriv.u1*(u1+u2>y)

if (y<u1) PSecDeriv.u1 <- 0

PSecDeriv.u2 <- f1prime(y-u2)*(1 -

VineCopula::BiCopHfunc2(F2(u2),F1(y-u2), family=1, par=rho)) +

f1(y-u2)*dCopula(c(F2(u2),F1(y-u2)), norm.cop)*f2(u2) -

f1(y-u2)*C22(F2(u2),F1(y-u2),rho)*f1(y-u2)

PSecDeriv.u2 <- PSecDeriv.u2*(u1+u2>y)

if (y<u2) PSecDeriv.u2 <- 0

return(c(PSecDeriv.u1,PSecDeriv.u2))

}

# Plot the Partial Derivatives

#u1=5000;u2 = 1500; y=4000;rho=0.5; PSecDeriv.fct(u1,u2, y)

PSecDeriv.arg <- seq(max(u1,u2)-500, u1+u2+500, length.out=20)

PSecDeriv.u1 <- 0*PSecDeriv.arg -> PSecDeriv.u2

for (kindex in 1:length(PSecDeriv.arg)) {

PSecDeriv.u1[kindex] <-

PSecDeriv.fct(u1,u2,rho, PSecDeriv.arg[kindex])[1]

PSecDeriv.u2[kindex] <-

PSecDeriv.fct(u1,u2,rho, PSecDeriv.arg[kindex])[2]

}

plot(PSecDeriv.arg,PSecDeriv.u1, type="l",

ylab="Partial Second Derivatives", xlab="y" )

lines(PSecDeriv.arg, PSecDeriv.u2, col = FigRed , lty =2)

text(5200, 0.0000010, expression(u[1]))

text(6000, 0.0000001, expression(u[2]))

# Determine the Partial Second Derivatives Using Numerical Approximations

# Agreement in these two approaches

# testpoint <- c(5000,1500,0.5,6000)

# PDeriv.fct.Vec.u1 <- function(par){PDeriv.fct(par[1],par[2],0.5,6000)[1]}

# PDeriv.fct.Vec.u2 <- function(par){PDeriv.fct(par[1],par[2],0.5,6000)[2]}

# 1e7*numDeriv::hessian(f=Prob.fct.Test.Vec, x = c(5000,1500))

# 1e7*numDeriv::hessian(f=Prob.fct.Vec, x = testpoint )

# # Note that cross-partial derivatives are incorrect numerically.

# # This is due to the boundary induced by u1 + u2 > y. Safe to ignore.

# 1e7*numDeriv::grad(f=PDeriv.fct.Vec.u1, x = testpoint)[1]

# 1e7*numDeriv::grad(f=PDeriv.fct.Vec.u2, x = testpoint)[2]

# 1e7*PSecDeriv.fct(5000,1500,0.5,6000)

# To check using simulation, need to increase the number of simulations,

# testpointA <- c(5000,1500,6000)

# Prob.Sim.Vec <- function(par){

# S <- pmin(X1,par[1]) + pmin(X2,par[2])

# mean((S <= par[3]))}

# Prob.Sim.Vec(testpointA)

# Prob.fct.Vec(testpoint)

# 1e7*numDeriv::jacobian(f=Prob.Sim.Vec, x = testpointA)

# 1e7*numDeriv::jacobian(f=Prob.fct.Vec, x = testpoint)

# 1e7*numDeriv::hessian(f=Prob.Sim.Vec, x = testpointA)

# 1e7*numDeriv::hessian(f=Prob.fct.Vec, x = testpoint)

Risk Measure Sensitivities

As described in Section 2.1, the uncertainty of retained risks can be summarized using a risk measure. Further, Section 2.3.2 showed how to compute

\[

\partial_{\theta} ~VaR_{\alpha}[g(X; \theta)] ~~~\text{and}~~~\partial_{\theta} ~ES_{\alpha}[g(X; \theta)],

\]

that is, the differential change in these risk measures per unit change in the parameter \(\theta\). The motivation is that it seems reasonable to want to know how such summary measures change in response to (small) changes in the risk retention parameters. The problems in Section 2.3.2 were rather specialized, with only a single random variable \(X\) and parameter \(\theta\). By making some mild additional assumptions to ensure smoothness, we are able to handle many additional situations. let us first introduce a general framework, and then specialize it to the two-risk excess of loss case.

Quantile Sensitivities

Specifically, now consider a generic random vector \(\mathbf{X}\) and let \(g(\mathbf{X}; \boldsymbol \theta)\) be a retention function that depends on outcomes in \(\mathbf{X}\) and a vector of parameters \(\boldsymbol \theta\). Let \(\Pr[ g(\mathbf{X};\boldsymbol \theta) \le y] = F(\boldsymbol \theta; y)\) be the distribution function of the random variable \(g(\mathbf{X};\boldsymbol \theta)\) with corresponding density function \(f(\boldsymbol\theta; \cdot)\). For fixed \(\boldsymbol \theta\), denote the inverse function at \(\alpha\) to be \(VaR_{\alpha}(\boldsymbol \theta)=VaR(\boldsymbol \theta)\), the value at risk (suppressing the explicit dependence on \(\alpha\)).

Assume sufficient local smoothness of \(F(\boldsymbol \theta; y)\) in both arguments \(y\) and \(\boldsymbol \theta\) to permit taking partial derivatives with respect to these arguments. Then, one can use calculus to develop the quantile sensitivity,

\[\begin{equation}

\begin{array}{ll}

\partial_{\boldsymbol \theta}VaR(\boldsymbol \theta) &=

\frac{-1}{F_y[\boldsymbol \theta; VaR(\boldsymbol \theta)]} F_{\boldsymbol \theta}[\boldsymbol \theta; VaR(\boldsymbol \theta)] .

\end{array}

\tag{5.5}

\end{equation}\]

Here, I use \(F_{\boldsymbol \theta}[\boldsymbol \theta; y] = \partial_{\boldsymbol \theta}F[\boldsymbol \theta; y]\) for the vector of partial derivatives with respect to \(\boldsymbol \theta\) and similarly for \(F_y\). Further, the matrix of second derivatives of the value at risk turns out to be

\[\begin{equation}

{\small

\begin{array}{ll}

&\partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

&= \frac{-1}{F_{y}[\boldsymbol \theta; VaR(\boldsymbol \theta)]}

\left\{F_{\boldsymbol \theta\boldsymbol \theta^{\prime}}[\boldsymbol \theta; VaR(\boldsymbol \theta)]+

F_{y y}[\boldsymbol \theta; VaR(\boldsymbol \theta)] \times

\partial_{\boldsymbol \theta}VaR(\boldsymbol \theta)

\partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta)

\right. \\

& ~~~~~~~

+ \left. \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta) \times F_{y \boldsymbol \theta^{\prime}}[\boldsymbol \theta; VaR(\boldsymbol \theta)]

+ F_{y \boldsymbol \theta}[\boldsymbol \theta; VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta) \right\} .\\

\end{array}

}

\tag{5.6}

\end{equation}\]

We assume local smoothness of \(F(\boldsymbol \theta,y)\) in both arguments \(y\) and \(\theta\) so that \(constant = F[\boldsymbol \theta,VaR(\boldsymbol \theta)]\) locally. Differentiating with respect to \(\boldsymbol \theta\) yields

\[

\begin{array}{ll}

0 &= \partial_{\boldsymbol \theta} F[\boldsymbol \theta,VaR(\boldsymbol \theta)] \\

& = \left. \partial_{\boldsymbol \theta} F[\boldsymbol \theta,y]\right|_{y=VaR(\boldsymbol \theta)}

+ \left. \partial_{y} F[\boldsymbol \theta,y]\right|_{y=VaR(\boldsymbol \theta)} \times \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta)\\

& = \left. F_{\boldsymbol \theta}[\boldsymbol \theta,y]\right|_{y=VaR(\boldsymbol \theta)}

+ \left. F_y[\boldsymbol \theta,y]\right|_{y=VaR(\boldsymbol \theta)} \times \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta)\\

& = F_{\boldsymbol \theta}[\boldsymbol \theta,VaR(\boldsymbol \theta)]

+ F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta).

\end{array}

\]

This is sufficient for equation (5.5).

Taking partial derivatives again, for the first term, we have

\[

\begin{array}{ll}

& \partial_{\boldsymbol \theta} F_{\boldsymbol \theta^{\prime}}[\boldsymbol \theta,VaR(\boldsymbol \theta)] = F_{\boldsymbol \theta\boldsymbol \theta^{\prime}}[\boldsymbol \theta,VaR(\boldsymbol \theta)]

+ \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta) \times F_{y\boldsymbol \theta^{\prime} }[\boldsymbol \theta,VaR(\boldsymbol \theta)] .

\end{array}

\]

For the second term, we have

\[

\begin{array}{ll}

& \partial_{\boldsymbol \theta}

\left\{F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta)

\right\} \\

&= \left\{\partial_{\boldsymbol \theta} ~F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \right\}

\times

\partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta)

+ F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta) \\

&=\left\{

F_{\boldsymbol \theta y}[\boldsymbol \theta,VaR(\boldsymbol \theta)] +

F_{y y}[\boldsymbol \theta,VaR(\boldsymbol \theta)] \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta)

\right\} \times \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta) \\

& \ \ \ \ + F_{y}[\boldsymbol \theta, VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta) .

\end{array}

\]

Putting this together, the matrix of second derivatives of the quantile, or value at risk, is as in equation (5.6).

Special Case. Two Risk Excess of Loss. In this case, the vector of parameters is \(\boldsymbol \theta = (u_1,u_2)^{\prime}\) and the retained risk function is the limited sum \(S(u_1,u_2)= X_1 \wedge u_1 + X_2 \wedge u_2\). The distribution function, density, density derivative, and quantile are:

\[

\begin{array}{ll}

F(\boldsymbol \theta; y) &= F(u_1, u_2;y) = \Pr[S(u_1,u_2) \le y] \\

F_y(\boldsymbol \theta; y) &= \partial_y ~ F(\boldsymbol \theta; y) = \partial_y ~ F(u_1, u_2;y) \\

F_{yy}(\boldsymbol \theta; y) &= \partial_y^2 ~ F(\boldsymbol \theta; y) = \partial_y^2 ~ F(u_1, u_2;y) \\

VaR(\boldsymbol \theta) &=F^{-1}_{\alpha}(u_1, u_2).

\end{array}

\]

From equations (5.2) and (5.3), the vector of first derivatives with respect to parameters of the distribution function is

\[

\begin{array}{ll}

F_{\boldsymbol \theta}(\boldsymbol \theta; y) & =F_{u_1, u_2}(u_1, u_2;y) \\

& =

\left(

\begin{array}{c}

- f_2(y-u_1)\left\{1-C_2[F_1(u_1),F_2(y-u_1)] \right\}\\

- f_1(y-u_2) \left\{1-C_2[F_2(u_2),F_1(y-u_2)] \right\}

\end{array}

\right) .

\end{array}

\]

Taking another partial derivative, one has

\[

\begin{array}{ll}

F_{\boldsymbol \theta y}(\boldsymbol \theta; y) & = \partial_y F_{u_1, u_2}(u_1, u_2; y) \\

&=

\left(

\begin{array}{c}

- \left[ f_2^{\prime}(y-u_1)\left\{1-C_2[F_1(u_1),F_2(y-u_1)] \right\} \right.\\

\left. - f_2^2(y-u_1)C_{22}[F_1(u_1),F_2(y-u_1)] \right]\\

- \left[ f_1^{\prime}(y-u_2) \left\{1-C_2[F_2(u_2),F_1(y-u_2)] \right\} \right.\\

-\left. f_1^2(y-u_2) C_{22}[F_2(u_2),F_1(y-u_2)] \right]\\

\end{array}

\right) .

\end{array}

\]

The matrix of second derivatives with respect to parameters of the distribution function is

\[

F_{\boldsymbol \theta\boldsymbol \theta^{\prime}}(\boldsymbol \theta; y) =

\left(

\begin{array}{cc}

\partial^2_{u_1} F(u_1,u_2;y) & 0 \\

0 & \partial^2_{u_2} F(u_1,u_2;y)\\

\end{array}

\right) ,

\]

where the diagonal elements are given in equation (5.4).

# Section 5.3.1 Illustrative Code, on Quantile Derivatives...

# f2prime <- function(y){ -f2(y)*(risk2shape+1)/(y+risk2scale) }

f1prime <- function(y){ ((risk1shape-1)/y - 1/risk1scale)*f1(y) }

CrossPDeriv.fct <- function(u1,u2,rho,y){

u1 <- u1*(u1>0)

u2 <- u2*(u2>0)

norm.cop <- copula::normalCopula(param=rho, dim = 2,'dispstr' ="un")

PSecDeriv.u1.y <-

f2prime(y-u1)*(1 -

VineCopula::BiCopHfunc2(F1(u1),F2(y-u1), family=1, par=rho)) +

- f2(y-u1)**2*C22(F1(u1),F2(y-u1),rho)

PSecDeriv.u1.y <- -PSecDeriv.u1.y*(u1+u2>y)

if (y<u1) PSecDeriv.u1.y <- 0

PSecDeriv.u2.y <-

f1prime(y-u2)*(1 -

VineCopula::BiCopHfunc2(F2(u2),F1(y-u2), family=1, par=rho)) +

f1(y-u2)*dCopula(c(F2(u2),F1(y-u2)), norm.cop)*f2(u2) -

f1(y-u2)**2*C22(F2(u2),F1(y-u2),rho)

PSecDeriv.u2.y <- -PSecDeriv.u2.y*(u1+u2>y)

if (y<u2) PSecDeriv.u2.y <- 0

return(c(PSecDeriv.u1.y,PSecDeriv.u2.y))

}

ExLossCTE <- function(u1,u2,rho,alpha){

# See Section 5.6 for Theory underpinning ES derivatives

Prob.alpha <- function(y){Prob.fct(u1,u2,rho,y) - alpha}

VaR <- uniroot(Prob.alpha, lower = 0, upper = 10e6)$root

Surv.fct.y <- function(y){1-Prob.fct(u1,u2,rho,y)}

Surv.fct.y.vec <- Vectorize(Surv.fct.y)

Sum.limited.Var <- integrate(Surv.fct.y.vec, lower = 0, upper = VaR)$value

TotalRetained <- actuar::levgamma(limit = u1,shape = risk1shape,

scale = risk1scale) +

actuar::levpareto(limit = u2,shape = risk2shape,

scale = risk2scale)

CTE <- VaR + (TotalRetained- Sum.limited.Var)/(1-alpha)

# Determine the density at the Quantile

densVaR <- numDeriv::grad(f=Prob.alpha, x = VaR)

# Later, do this analytically

# Determine the partial derivatives at the quantile

Pderivs <- PDeriv.fct(u1,u2,rho,VaR)

# Determine the quantile sensitivities (Eqn 5.6)

VaRSens <- -Pderivs/densVaR

# often, close to zero

ContinuityAdjust <- 1 - (1-Prob.fct(u1,u2,rho,VaR))/(1-alpha)

norm.cop <- copula::normalCopula(param=rho, dim = 2,'dispstr' ="un")

CTESens <- 0 *VaRSens

CTESens[1] <- 1-F1(u1) - (F2(VaR-u1) -

copula::pCopula(c(F1(u1),F2(VaR-u1)), norm.cop))

CTESens[1] <- CTESens[1]/(1-alpha) + ContinuityAdjust*VaRSens[1]

CTESens[2] <- 1-F2(u2) -

(F1(VaR-u2) - copula::pCopula(c(F2(u2),F1(VaR-u2)), norm.cop))

CTESens[2] <- CTESens[2]/(1-alpha) + ContinuityAdjust*VaRSens[2]

#CTESens

FythetaCross <- CrossPDeriv.fct(u1,u2,rho,VaR)

temp <- FythetaCross %*% t(VaRSens)

HessVaR <- (1/densVaR)* (diag(PSecDeriv.fct(u1,u2,rho,VaR)) +

numDeriv::hessian(f=Prob.fct.Vec, x = c(u1,u2,rho,VaR))[3,3] *

FythetaCross %*% t(VaRSens) + temp + t(temp) )

HessCTE <- ContinuityAdjust*HessVaR

HessCTE[1,1] <- HessCTE[1,1] + (-f1(u1) - f2(VaR-u1)*(1 -

VineCopula::BiCopHfunc2(F1(u1),F2(VaR-u1), family=1, par=rho)))/(1-alpha)

HessCTE[2,2] <- HessCTE[2,2] + (-f2(u2) - f1(VaR-u2)*(1 -

VineCopula::BiCopHfunc2(F2(u2),F1(VaR-u2), family=1, par=rho)))/(1-alpha)

Output <- list(VaR,CTE, VaRSens, CTESens, HessVaR, HessCTE)

return(Output)

}

# Initial parameters

u1 <- 5000;u2 <- 1500; rho <- 0.5;alpha <- 0.85

rhoVec <- seq(-0.2, 0.8, length.out=11)

VaR.Vec1 <- 0* rhoVec -> CTE.Vec1

VaR.Sens1 <- matrix(0,ncol =2, nrow = length(rhoVec)) -> CTE.Sens1

detHessVaR1 <- 0* rhoVec -> detHessCTE1

for (kindex in 1:length(rhoVec)) {

temp <- ExLossCTE(u1,u2, rho=rhoVec[kindex],alpha)

VaR.Vec1[kindex] <- temp[[1]]

CTE.Vec1[kindex] <- temp[[2]]

VaR.Sens1[kindex,] <- temp[[3]]

CTE.Sens1[kindex,] <- temp[[4]]

detHessVaR1[kindex] <- det(temp[[5]])

detHessCTE1[kindex] <- det(temp[[6]])

}

alphaVec <- seq(0.55, 0.95, length.out=10)

VaR.Vec2 <- 0* alphaVec -> CTE.Vec2

VaR.Sens2 <- matrix(0,ncol =2, nrow = length(alphaVec)) -> CTE.Sens2

detHessVaR2 <- 0* alphaVec -> detHessCTE2

for (kindex in 1:length(alphaVec)) {

temp <- ExLossCTE(u1,u2, rho,alpha = alphaVec[kindex])

VaR.Vec2[kindex] <- temp[[1]]

CTE.Vec2[kindex] <- temp[[2]]

VaR.Sens2[kindex,] <- temp[[3]]

CTE.Sens2[kindex,] <- temp[[4]]

detHessVaR2[kindex] <- det(temp[[5]])

detHessCTE2[kindex] <- det(temp[[6]])

}

save(alphaVec,VaR.Vec2,VaR.Sens2,rhoVec,VaR.Vec1,VaR.Sens1,alpha,

CTE.Vec1,CTE.Sens1,CTE.Vec2,CTE.Sens2,

file = "../ChapTablesData/Chap5/Sec531QuantileDeriv.RData")

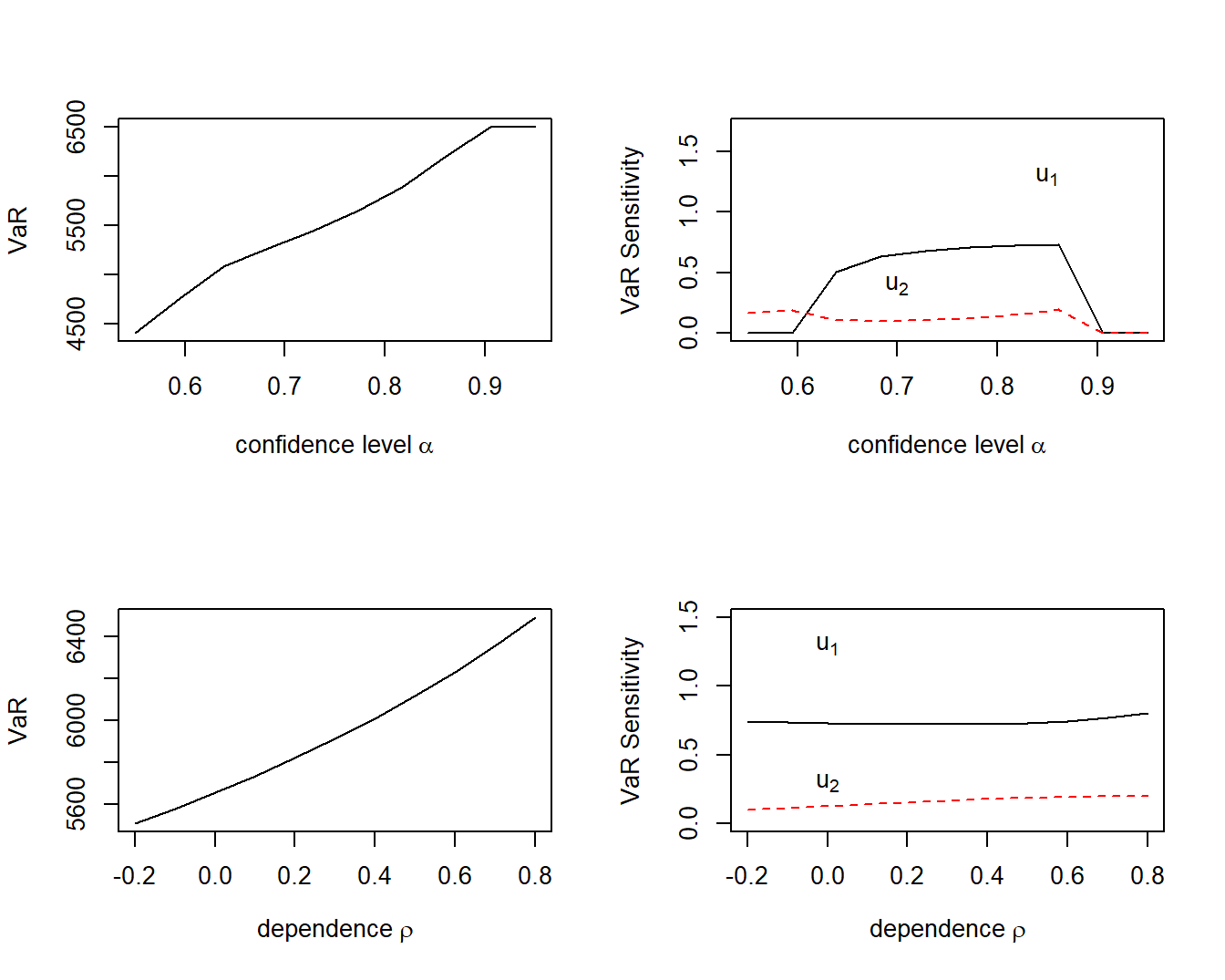

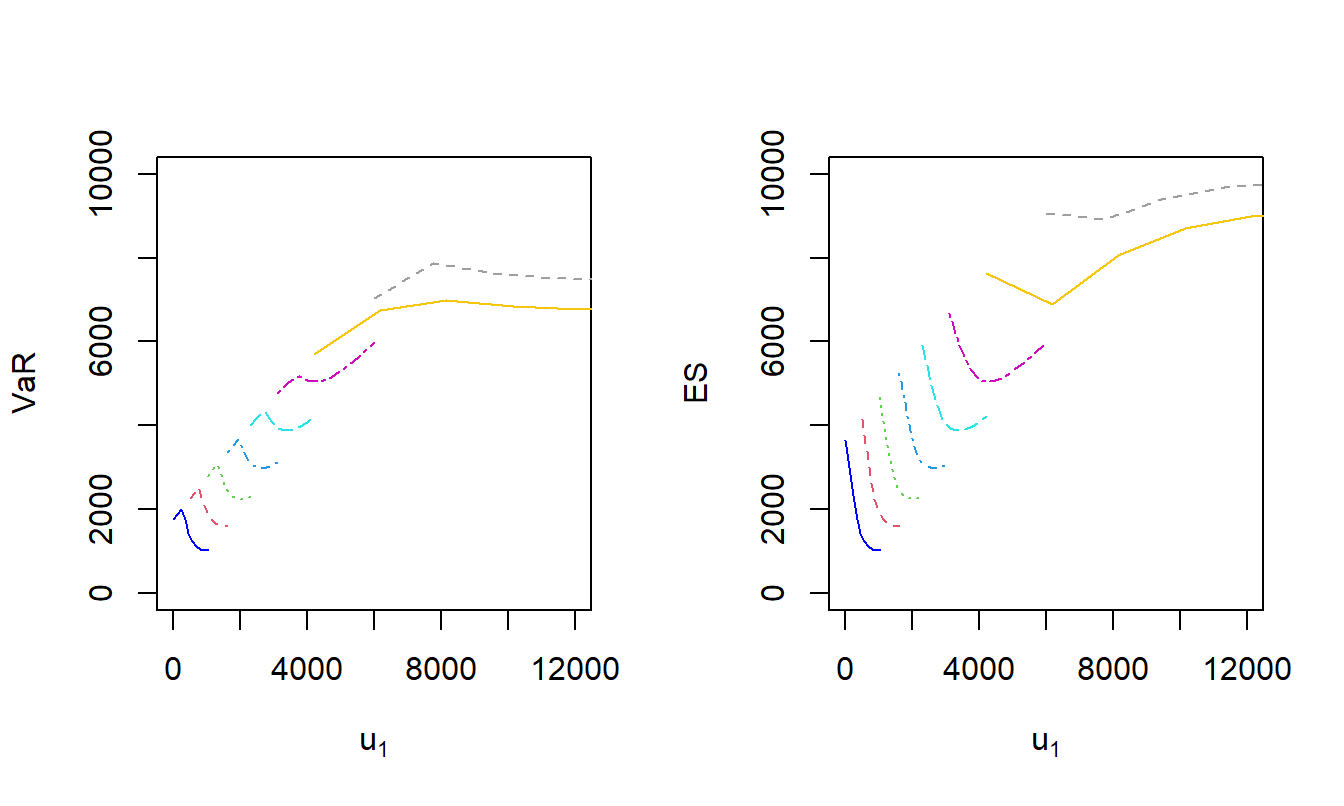

Example 5.6. Bivariate Excess of Loss VaR Sensitivities. Let us continue to use the distribution and parameter values from Example 5.3 and \(\alpha = 0.85\). As anticipated, from Figure 5.7 we see that the value at risk increases as both the confidence level \(\alpha\) increases (top left panel) and as the dependence parameter \(\rho\) increases (bottom left panel). The two right-hand panels show that both \(VaR\) sensitivities are positive for all values of \(\alpha\) and \(\rho\).

Expected Shortfall Sensitivities

The development of the \(ES\) sensitivity employs an auxiliary function that will also be useful for us in other contexts. To define this function, consider a generic random variable \(Y\) having distribution function \(F_Y\) with a unique \(\alpha\) quantile, \(F^{-1}(\alpha)\). Now, define the function

\[

ES1_F(z) = z + \frac{1}{1-\alpha} \left\{\mathrm{E}[Y] -\mathrm{E}[Y \wedge z]\right\} .

\]

From equation (2.3), one sees that the auxiliary function evaluated at the quantile is the expected shortfall, that is, \(ES(\alpha)=ES1_F(VaR_{\alpha})\).

After some calculations using this auxiliary function, one can show

\[\begin{equation}

\begin{array}{ll}

\partial_{\boldsymbol \theta} ~ES_{\alpha}[g(\mathbf{X};\theta)]

&=\frac{1}{1-\alpha} \left\{\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta)] -\left.\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\right\} \\

&\ \ \ \ \ \ \ \ + \left( 1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} VaR(\boldsymbol \theta).

\end{array}

\tag{5.7}

\end{equation}\]

Further,

\[\begin{equation}

\begin{array}{ll}

& \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} ~ES_{\alpha}[g(\mathbf{X};\theta)] \\

&=

\frac{1}{1-\alpha} \left\{ \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta)] -\left. \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\right\}\\

& \ \ \ \ \ \ \ + \left(1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

& \ \ \ \ \ \ \ + \frac{1}{(1-\alpha)} F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta)

\times \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) .\\

\end{array}

\tag{5.8}

\end{equation}\]

Note that if \(VaR(\boldsymbol \theta)\) is a point of continuity (no discrete jump in the distribution function), then \(F[\boldsymbol \theta;VaR(\boldsymbol \theta)]= \alpha\). In this case, equations (5.7) and (5.8) become simpler. Specifically, the second term on the right-hand side of each equation becomes zero.

For the auxiliary function, define \(ES1_F(\boldsymbol \theta;y) = y + \frac{1}{1-\alpha} \left\{\mathrm{E}[g(X;\boldsymbol \theta)] -\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right\}\).

Using equation (2.7), it is easy to see that \(\partial_y\mathrm{E}[g(X;\boldsymbol \theta) \wedge y] = 1-F(\boldsymbol \theta;y)\). Thus,

\[

\begin{array}{ll}

\partial_y ~ES1_F(\boldsymbol \theta;y) & = 1 - \frac{1}{1-\alpha} [1-F(\boldsymbol \theta;y)] .\\

\end{array}

\]

Now, with the other set of partial derivatives

\[

\begin{array}{ll}

\partial_{\boldsymbol \theta} ~ES1_F(\boldsymbol \theta;y) & = \frac{1}{1-\alpha} \left\{\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta)] -\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right\} ,

\end{array}

\]

we can take differentials to yield

\[

{\small

\begin{array}{ll}

& \partial_{\boldsymbol \theta} ~ES_{\alpha}[g(\mathbf{X};\theta)] \\

&=

\partial_{\boldsymbol \theta} ~ES1_F[\boldsymbol \theta;VaR(\boldsymbol \theta)] \\

&= \left. \partial_{\boldsymbol \theta} ES1_F(\boldsymbol \theta;y) \right|_{y=VaR(\boldsymbol \theta)}

+ \left. \partial_{y} ES1_F(\boldsymbol \theta;y) \right|_{y=VaR(\boldsymbol \theta)}

\times \partial_{\boldsymbol \theta} VaR(\boldsymbol \theta) \\

&=\frac{1}{1-\alpha} \left\{\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta)] -\left.\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\right\} \\

&\ \ \ \ \ \ \ \ + \left( 1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} VaR(\boldsymbol \theta) ,

\end{array}

}

\]

as in equation (5.7).

Now consider partial second derivatives. First note that, because \(\partial_y\mathrm{E}[g(X;\boldsymbol \theta) \wedge y] = 1-F(\boldsymbol \theta;y)\), we have

\[

\begin{array}{ll}

\partial_y \partial_{\boldsymbol \theta}~\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]

& = -\partial_{\boldsymbol \theta}F(\boldsymbol \theta;y) . \\

\end{array}

\]

With this, for the second term on the right hand side of equation (5.7), we have

\[

\begin{array}{ll}

\partial_{\boldsymbol \theta} &\left.\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\\

&= \left.\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\\

& \ \ \ \ \ \ \ +\left.\partial_y \partial_{\boldsymbol \theta}~\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}

\times \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta)\\

&= \left.\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\\

& \ \ \ \ \ \ \ - \left.\partial_{\boldsymbol \theta}F[\boldsymbol \theta;y]\right|_{y=VaR(\boldsymbol \theta)}

\times \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta) .\\

\end{array}

\]

For the third term in equation (5.7),

\[

\begin{array}{ll}

\partial_{\boldsymbol \theta} & \left( 1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

&= \left( 1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

& \ \ \ \ \ + \left(\frac{1}{1-\alpha} \partial_{\boldsymbol \theta} F[\boldsymbol \theta,VaR(\boldsymbol \theta)]

\right) \times \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta).

\end{array}

\]

Putting these together yields

\[

\begin{array}{ll}

& \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} ~ES_{\alpha}[g(\mathbf{X};\theta)] \\

&= \frac{1}{1-\alpha} \left\{\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta)] -\left.\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\right.\\

& \ \ \ \ \ \left. - ~\left.\partial_{\boldsymbol \theta}F[\boldsymbol \theta;y]\right|_{y=VaR(\boldsymbol \theta)}

\times \partial_{\boldsymbol \theta^{\prime}}VaR(\boldsymbol \theta) \right\} \\

& \ \ \ \ \ + \left(1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

& \ \ \ \ \ + \frac{1}{1-\alpha} \partial_{\boldsymbol \theta} F[\boldsymbol \theta,VaR(\boldsymbol \theta)]

\times \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta). \\

&= \frac{1}{1-\alpha} \left\{\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta)] -\left.\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\right\}\\

& \ \ \ \ \ + \left(1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

& \ \ \ \ \ + \frac{1}{1-\alpha} \left(\partial_{\boldsymbol \theta} F[\boldsymbol \theta,VaR(\boldsymbol \theta)] -

\left.\partial_{\boldsymbol \theta}F[\boldsymbol \theta;y]\right|_{y=VaR(\boldsymbol \theta)} \right)

\times \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta)\\

&= \frac{1}{1-\alpha} \left\{\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta)] -\left.\partial_{\boldsymbol \theta}\partial_{\boldsymbol \theta^{\prime}}\mathrm{E}[g(X;\boldsymbol \theta) \wedge y]\right|_{y=VaR(\boldsymbol \theta)}\right\}\\

& \ \ \ \ \ + \left(1 - \frac{1}{1-\alpha} \{1-F[\boldsymbol \theta;VaR(\boldsymbol \theta)]\} \right)

\times \partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) \\

& \ \ \ \ \ + \frac{1}{1-\alpha} F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta)

\times \partial_{\boldsymbol \theta^{\prime}} VaR(\boldsymbol \theta) ,\\

\end{array}

\]

where, in the last line, we recall that

\[

\partial_{\boldsymbol \theta} F[\boldsymbol \theta,VaR(\boldsymbol \theta)]

= F_{\boldsymbol \theta}[\boldsymbol \theta,VaR(\boldsymbol \theta)]

+ F_y[\boldsymbol \theta,VaR(\boldsymbol \theta)] \times \partial_{\boldsymbol \theta}VaR(\boldsymbol \theta).

\]

This is sufficient for equation (5.8).

Special Case. Two Risk Excess of Loss. As before, the vector of parameters is \(\boldsymbol \theta = (u_1,u_2)^{\prime}\) and the retained risk function is \(S(u_1,u_2)= X_1 \wedge u_1 + X_2 \wedge u_2\). In this case, we have

\[

\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta)] =

\left(\begin{array}{ll}

\partial_{u_1}\mathrm{E}[S(u_1,u_2)] \\

\partial_{u_2}\mathrm{E}[S(u_1,u_2)]

\end{array}\right)

= \left(\begin{array}{ll}

1-F_1(u_1) \\

1-F_2(u_2)

\end{array}\right)

\]

and

\[\begin{equation}

\partial_{\boldsymbol \theta}\mathrm{E}[g(X;\boldsymbol \theta)\wedge y] =

\left(\begin{array}{ll}

F_2(y-u_1) - C[F_1(u_1),F_2(y-u_1)] \\

F_1(y-u_2) - C[F_2(u_2),F_1(y-u_2)]

\end{array}\right) .

\tag{5.9}

\end{equation}\]

To see equation (5.9), we have the following.

\[

\begin{array}{ll}

\partial_{\boldsymbol \theta} \left\{\mathrm{E}[g(X;\boldsymbol \theta)\wedge y] \right\}

& = \partial_{\boldsymbol \theta} \left\{\int^y_{-\infty} [1-F(\boldsymbol \theta;z)]dz \right\} = -\int^y_{-\infty} ~F_{\boldsymbol \theta}(\boldsymbol \theta;z) dz .\\

\end{array}

\]

For the first retention parameter, using equation (5.2), we have

\[

\begin{array}{ll}

&\partial_{u_1} \left\{\mathrm{E}[g(X;\boldsymbol \theta)\wedge y] \right\} \\

& = -\int^y_{-\infty} ~F_{u_1}(u_1,u_2;z) dz \\

& = \int^y_{-\infty} ~f_2(z-u_1)\left\{1-C_2[F_1(u_1),F_2(z-u_1)] \right\} dz \\

& = F_2(y-u_1) - \int^y_{-\infty} ~\partial_z C[F_1(u_1),F_2(z-u_1)] dz \\

& = F_2(y-u_1) - C[F_1(u_1),F_2(y-u_1)] \\

& = \Pr(X_1 > u_1, X_2 \le y-u_1) .

\end{array}

\]

This is sufficient for equation (5.9).

Taking derivatives again yields

\[

\partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta ^{\prime}} ~\mathrm{E}[g(X;\boldsymbol \theta)] =

- \left(\begin{array}{cc}

f_1(u_1) &0\\

0 & f_2(u_2)

\end{array}\right)

\]

and

\[

{\small

\begin{array}{ll}

\partial_{\boldsymbol \theta} \partial_{\boldsymbol \theta ^{\prime}} \mathrm{E}[g(X;\boldsymbol \theta)\wedge y] \\

\ \ \ =

\left(\begin{array}{cc}

f_2(y-u_1) \{1 - C_2[F_1(u_1),F_2(y-u_1)]\} & 0 \\

0& f_1(y-u_2)\{1 - C_2[F_2(u_2),F_1(y-u_2)] \}

\end{array}\right) .

\end{array}

}

\]

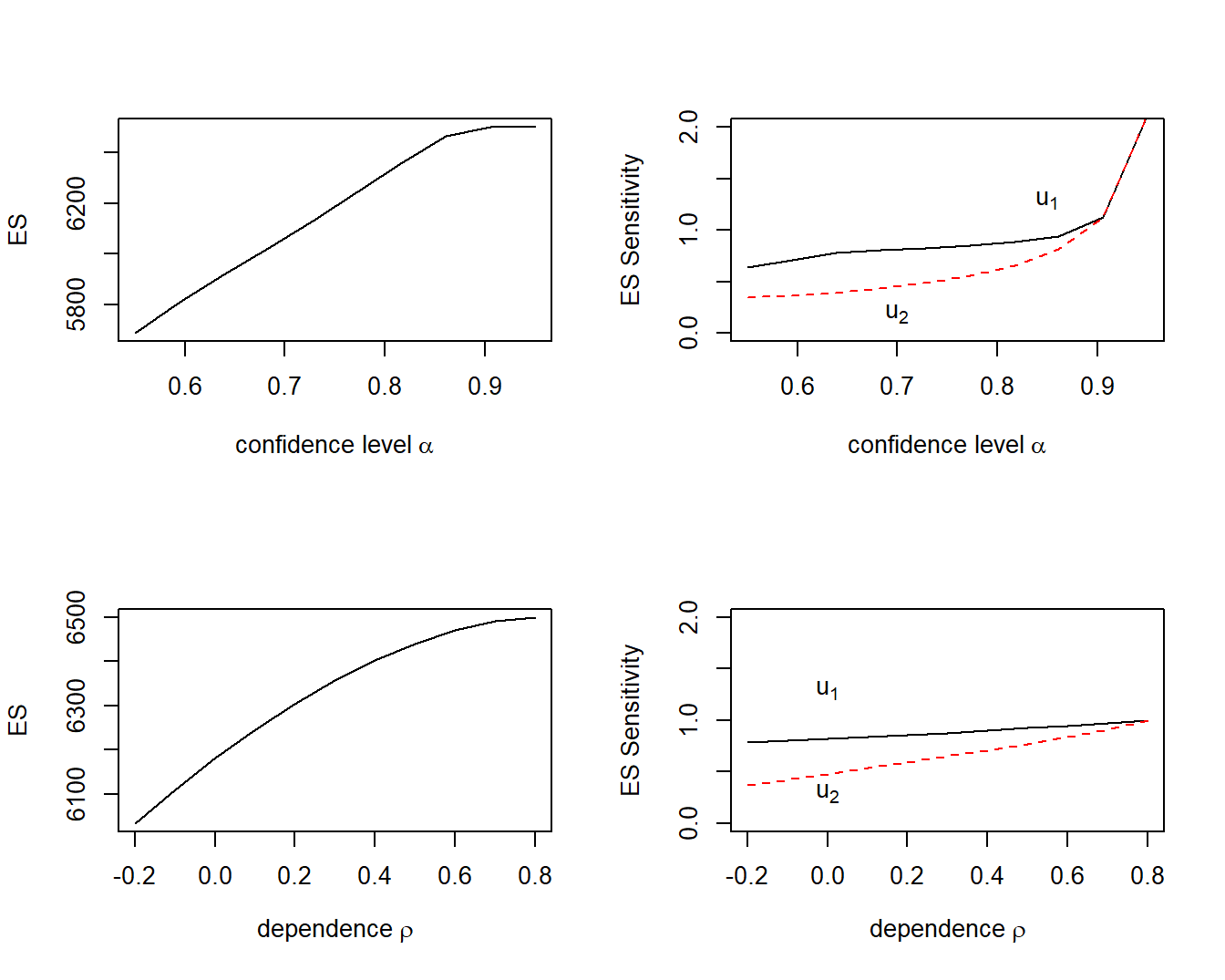

Example 5.7. Bivariate Excess of Loss - \(ES\) Sensitivities. We use the distribution and parameter values from Example 5.3 and \(\alpha = 0.85\). These yield interesting results in Figure 5.8.

Looking Forward. Sensitivity analysis will be the main theme of Chapters 9 and 10 so the foundations laid in this section will bear fruit for us later on. From this section’s detailed calculation of sensitivities, observe that the key aspect is the smoothness of parameters in potential outcomes of the retained risk and the retention parameters \(\boldsymbol \theta\). This smoothness is important and will motivate the introduction of kernel methods when we introduce simulation methods in Chapter 7.

Visualizing Constrained Optimization

Using constrained optimization, the goal is to find those parameter values \(u_1,u_2\) that minimizes an uncertainty measure of retained risk subject to the budget constraint that the risk transfer costs are limited by a given amount, \(RTC_{max}\). With the equation (3.3) structure, one can write this as

\[\begin{equation}

\boxed{

\begin{array}{lc}

{\small \text{minimize}_{u_1,u_2}} & ~~~~~RM[S(u_1, u_2)] \\

{\small \text{subject to}} & ~~~~~RTC(u_1, u_2) \le RTC_{max} \\

&u_1 \ge 0, \ \ \ \ u_2 \ge 0 .

\end{array}

}

\tag{5.10}

\end{equation}\]

This section introduces visualization techniques to help us understand the nuances of constrained optimization risk retention problems. As seen in Figure 5.4, it can be difficult to visualize a risk measure as a function of two upper limits. In addition, we want to get some insights by adding the budget constraint function that also could be represented as a three-dimensional figure (the constraint as a function of two upper limits). Instead, it is common in constrained optimization to utilize contours, a curve that is a function of two variables in which the function has a constant value.

Visualizing the Excess of Loss Problem

To explore visualization techniques, we start with \(ES\) minimization and then move on to \(VaR\) minimization. As will be demonstrated in Section 5.5, \(VaR\) minimization can be problematic.

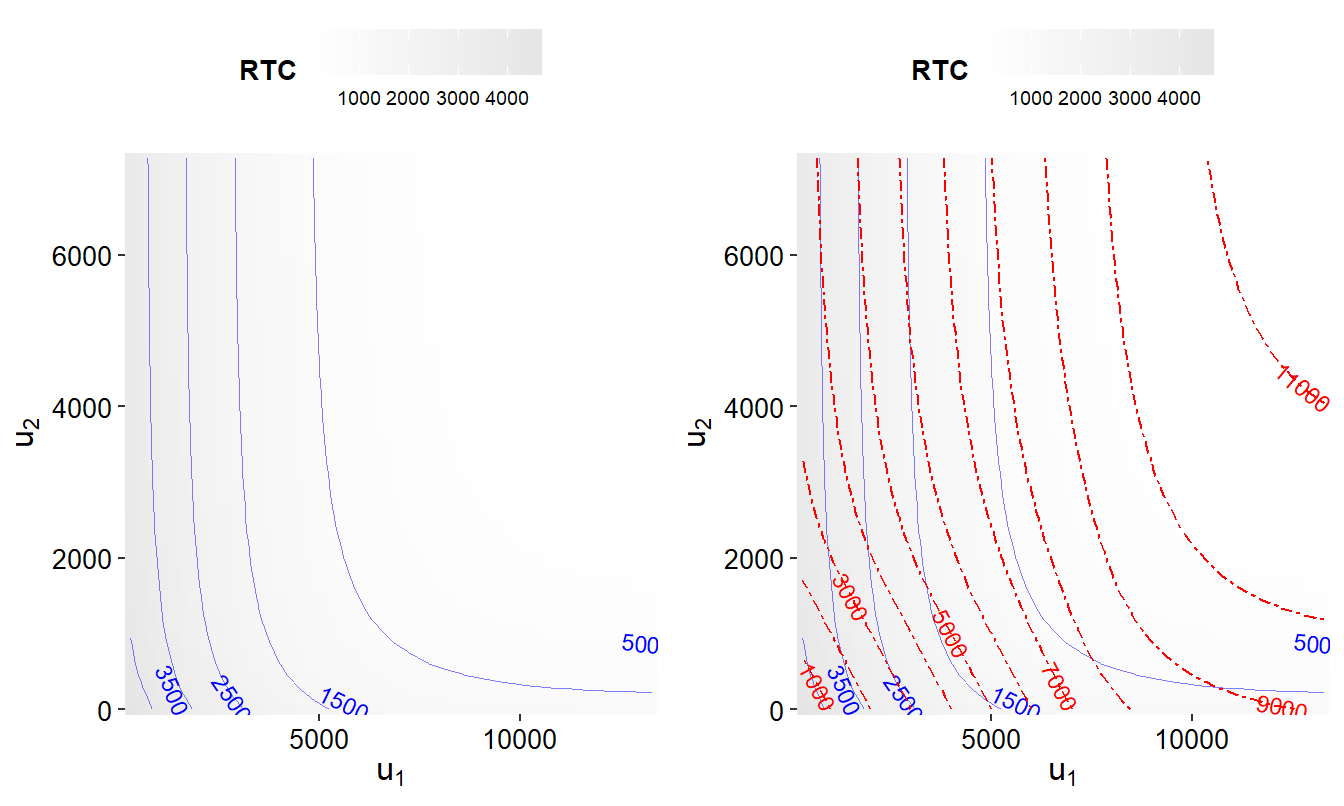

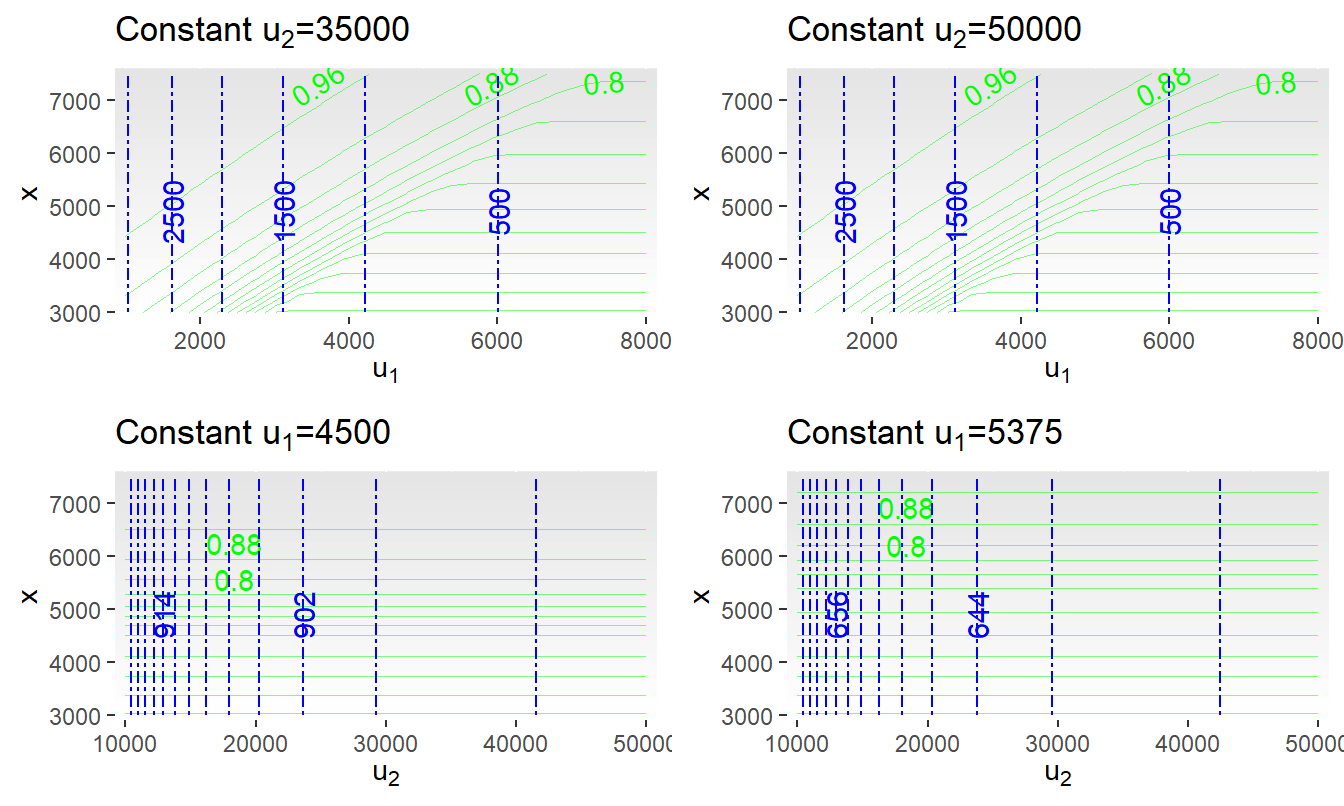

Example 5.8. Visualizing Excess of Loss Constrained Optimization - ES. Consider the distributions specified in Example 5.3, using a positive correlation \(\rho = 0.5\) and a confidence level \(\alpha = 0.85\). Figure 5.9 shows contours of the expected shortfall risk measure \(ES\) and the risk transfer cost \(RTC\) for several choices of upper limits \((u_1, u_2)\).

Specifically, the left-hand panel of Figure 5.9 shows the contours of the risk transfer cost \(RTC\) as solid blue curves. For this plot, darker shaded values indicate a larger value of \(RTC\). The contours are constant \(RTC\) slices as one might take in a three-dimensional graph such as Figure 5.4. For example, if \(RTC_{max} = 500\), then the feasibility region \(\{(u_1, u_2):RTC(u_1, u_2) \le 500\}\) corresponds to the area to the right and above the blue curve corresponding to \(RTC_{max} =500\).

The right-hand panel retains these contours with constant values of the expected shortfall \(ES\) superimposed as dashed red curves. For the optimization problem in Display (5.10), the objective is to find the smallest contour subject to being within this feasibility region. At the point of intersection where the smallest contour just meets the budget curve, the two curves are parallel.

# Example 5.8 Illustrative Code, Figure 5.9

# save(RMGridPos,

# file = "../ChapTablesData/Chap5/Example521PosCorr.RData")

load( file = "ChapTablesData/Chap5/Example521PosCorr.RData")

ggRTC <- ggplot2::ggplot(RMGridPos, aes(x = u1, y = u2)) +

geom_raster(aes(fill = RTC)) +

geom_contour(aes(z = RTC), colour = FigBlue,

size = 0.1, alpha = 0.5, bins = 6) +

geom_text_contour(aes(z = RTC), colour = FigBlue, size = 3) +

labs(x = expression(u[1]), y = expression(u[2]), fill = "RTC") +

theme(legend.title = element_text(size = 10, face = "bold"),

legend.position = "top", panel.background = element_blank(),

axis.text = element_text(colour = "black", size = 10),

axis.title = element_text(size = 12, face = "italic"),

legend.text = element_text(size = 7),

legend.key = element_blank() ) +

scale_fill_continuous(low = "white", high = "grey90") +

scale_y_continuous(expand = c(0,0) ) +

scale_x_continuous(expand = c(0,0) )

ggPosCTE2 = ggRTC +

geom_contour(aes(z = ES), colour = FigRed, linetype = 18) +

geom_text_contour(aes(z = ES), colour = FigRed , size = 3)

gridExtra::grid.arrange(ggRTC,ggPosCTE2,nrow=1)

# Example 5.9 Illustrative Code, Figure 5.10

ggPosVar2 = ggRTC +

geom_contour(aes(z = VaR), colour = FigRed, linetype = 18) +

geom_text_contour(aes(z = VaR), colour = FigRed , size = 3)

ggPosVar2

To appreciate this visualization of the optimization problem, it is helpful to know where the optimal values lie when visualizing this graph. With \(RTC_{max} = 1,500\), when minimizing \(ES\), it turns out that the best values of the retention limits are \(u_1^* =3,379\) and \(u_2^* = 3,387\) with expected shortfall \(ES^* =5,997\). This allows one to identify this point in Figure 5.9.

Example 5.9. Visualizing Excess of Loss Constrained Optimization - VaR. Continuing from Example 5.8, we now consider the value at risk \(VaR\) risk measure. Figure 5.10 shows the \(RTC\) as solid blue curves and the \(VaR\) as dashed red curves. When the constraint is binding, the objective is to find the smallest contour subject to being at a given level of the risk transfer cost.

As before, it is helpful to know where the optimal values lie. It turns out that the best risk retention values are \(u_1^* =3,116\) and \(u_2^* =43,375\) (essentially infinity), resulting in a value at risk \(VaR^* =4,761\).

Similar calculations can be performed for other values of \(RTC_{max}\). For example, if \(RTC_{max} = 2,500\), it turns out that the best risk retention values are \(u_1^* =1,628\) and \(u_2^* =23,117\), resulting in a value at risk \(VaR^* =3,376\). As suggested by the graph, large changes in \(u_2\) mean only small changes in the optimal values of \(u_1\) and the \(VaR\), suggesting that they are not sensitive to \(u_2\).

From Figure 5.10, one sees that for this example we are able to determine the value of \(u_1\) well but determining a value of \(u_2\) is more problematic. When comparing this figure to the \(ES\) contour plot in Figure 5.10, it seems like the distinction between \(ES\) and \(RTC\) contours is more pronounced than the distinction between \(VaR\) and \(RTC\) contours, suggesting that it is easier to determine the optimal values for the \(ES\) problem.

Using Distribution Functions

When the risk measure is the value at risk (\(VaR\)), an equivalent problem formulation is

\[\begin{equation}

\boxed{

\begin{array}{lc}

{\small \text{minimize}_{u_1,u_2,x}} & ~~~~~x \\

{\small \text{subject to}} & ~~~~~\Pr[S(u_1, u_2) \le x] \ge \alpha \\

& ~~~~~RTC(u_1, u_2) \le RTC_{max} \\

&u_1 \ge 0, \ \ \ \ u_2 \ge 0 .

\end{array}

}

\tag{5.11}

\end{equation}\]

Intuitively, finding the smallest \(x\) value that minimizes the probability condition is equivalent to the quantile as described in Section 2.1. In this section, we simply provide code that solves each problem and show the equivalence between the two solutions. Section 7.2 will develop this general approach in a broader context, explaining its strengths and limitations compared to the basic approach, such as in Display (5.10).

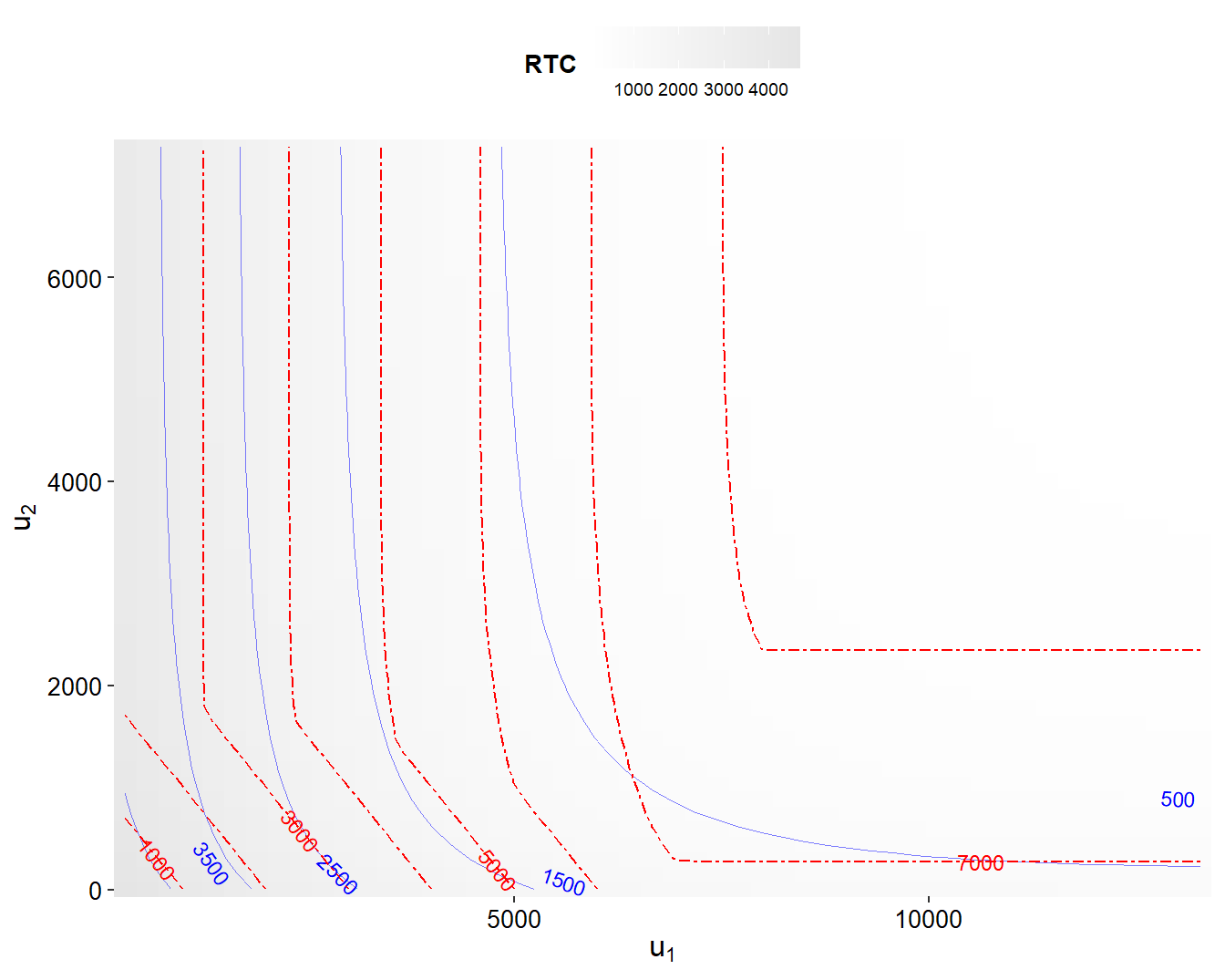

The minimization problem in Display (5.11) is complicated to visualize because now there are three decision variables, \(x\), \(u_1\), and \(u_2\), over which one seeks to evaluate the probability of the retained risk \(\Pr[S(u_1,u_2) \le x]\) and the risk transfer cost \(RTC\). Figure 5.11 shows different aspects of the problem; the top two panels hold the value of \(u_2\) as constant and the bottom two hold \(u_1\) constant. The upper left-hand panel is a contour plot of the probability of retained risk with the solid green curves representing the contours (the background shading is for values of \(x\)). As before, the dashed blue curves represent contours of the \(RTC\). For this panel, because we hold \(u_2=35,000\) fixed, the contour of \(RTC\) is simply a constant vertical line. The value of \(u_1 = 6,000\) corresponds to a risk transfer cost of \(RTC=500\). When \(x=7,000\), this vertical line is close to the contour corresponding to a probability value of 0.85. As we see below, these values turn out to give near optimal values.

There is little difference when comparing the top two panels of Figure 5.11. This is because the surface is relatively flat over different values of \(u_2\), meaning that changes in this variable have relatively little effect on the problem solution. The bottom two panels of Figure 5.11 each hold \(u_1\) constant. Here, in addition to vertical lines for the contours of \(RTC\), we see near horizontal lines for the contours of \(\Pr[S(u_1,u_2) \le x]\). This is additional evidence that changes in \(u_2\) have relatively little effect on the problem solution.

# Section 5.4.2, Figure 5.11

load( file = "ChapTablesData/Chap5/Sec542RMGridNoDFCorrB.RData")

lengthGrid = length(RMGridNoDF[,"u1"])

midpoint = RMGridNoDF[round(lengthGrid/2),]

RMGridNoDFmidu1A <- subset(RMGridNoDF, u1==as.numeric(midpoint["u1"]))

RMGridNoDFmidu1B <- subset(RMGridNoDF, u1==5375)

RMGridNoDFmidu2A <- subset(RMGridNoDF, u2==35000)

RMGridNoDFmidu2B <- subset(RMGridNoDF, u2==50000)

# str(RMGridNoDF)

# table(RMGridNoDF$u1)

# table(RMGridNoDF$u2)

breaksProb <- seq(0.80, 0.96, by = 0.04)

breaksRTC <- seq(200, 1200, by = 6)

ggNoDFConu1A = ggplot(RMGridNoDFmidu1A, aes(x = u2, y = x)) +

geom_raster(aes(fill = x)) +

geom_contour(aes(z = Prob), colour = FigGreen, size = 0.2, alpha = 0.5) +

geom_text_contour(aes(z = Prob), colour = FigGreen ,breaks = breaksProb) +

geom_contour(aes(z = RTC), colour = FigBlue, linetype = 18) +

geom_text_contour(aes(z = RTC), colour = FigBlue ,breaks = breaksRTC) +

theme(legend.position = "none") +

scale_fill_continuous(low = "white", high = "grey90") +

scale_y_continuous(expand = c(0,0)) +

scale_x_continuous(expand = c(0,0)) +

labs(x = expression(u[2]), title =expression(paste('Constant ', u[1], '=4500'))) #

ggNoDFConu1B = ggplot(RMGridNoDFmidu1B, aes(x = u2, y = x)) +

geom_raster(aes(fill = x)) +

geom_contour(aes(z = Prob), colour = FigGreen, size = 0.2, alpha = 0.5) +

geom_text_contour(aes(z = Prob), colour = FigGreen ,breaks = breaksProb) +

geom_contour(aes(z = RTC), colour = FigBlue, linetype = 18) +

geom_text_contour(aes(z = RTC), colour = FigBlue ,breaks = breaksRTC) +

theme(legend.position = "none") +

scale_fill_continuous(low = "white", high = "grey90") +

scale_y_continuous(expand = c(0,0)) +

scale_x_continuous(expand = c(0,0)) +

labs(x = expression(u[2]), title =expression(paste('Constant ', u[1], '=5375')))

ggNoDFConu2A = ggplot(RMGridNoDFmidu2A, aes(x = u1, y = x)) +

geom_raster(aes(fill = x)) +

geom_contour(aes(z = Prob), colour = FigGreen, size = 0.2, alpha = 0.5) +

geom_text_contour(aes(z = Prob), colour = FigGreen ,breaks = breaksProb) +

geom_contour(aes(z = RTC), colour = FigBlue,linetype = 18) +

geom_text_contour(aes(z = RTC), colour = FigBlue ) +

theme(legend.position = "none") +

scale_fill_continuous(low = "white", high = "grey90") +

scale_y_continuous(expand = c(0,0)) +

scale_x_continuous(expand = c(0,0)) +

labs(x = expression(u[1]), title =expression(paste('Constant ', u[2], '=35000')))

ggNoDFConu2B = ggplot(RMGridNoDFmidu2B, aes(x = u1, y = x)) +

geom_raster(aes(fill = x)) +

geom_contour(aes(z = Prob), colour = FigGreen, size = 0.2, alpha = 0.5) +

geom_text_contour(aes(z = Prob), colour = FigGreen ,breaks = breaksProb) +

geom_contour(aes(z = RTC), colour = FigBlue, linetype = 18) +

geom_text_contour(aes(z = RTC), colour = FigBlue ) +

theme(legend.position = "none") +

scale_fill_continuous(low = "white", high = "grey90") +

scale_y_continuous(expand = c(0,0)) +

scale_x_continuous(expand = c(0,0)) +

labs(x = expression(u[1]), title =expression(paste('Constant ', u[2], '=50000')))

gridExtra::grid.arrange(ggNoDFConu2A,ggNoDFConu2B,

ggNoDFConu1A,ggNoDFConu1B, nrow=2)

To help interpret the figures, note that the optimal values of the problem in Display (5.11) are equivalent to those in Display (5.10). Interestingly the code for this alternative formulation (as in Display (5.11)) is much faster than for the code that optimizes directly the \(VaR\) risk measure. Intuitively, one can see in Figure 5.11 the sharp distinction among the contour curves. This is in contrast to the earlier Figure 5.9 where the near parallel contours suggested difficulties in the algorithms arriving at optimal solutions.

Restricting the Feasible Region

As in Display (5.10), we seek to solve the problem

\[

\boxed{

\begin{array}{lc}

{\small \text{minimize}_{u_1,u_2}} & ~~~~~RM[S(u_1, u_2)] \\

{\small \text{subject to}} & ~~~~~RTC(u_1, u_2) \le RTC_{max} \\

&u_1 \ge 0, \ \ \ \ u_2 \ge 0 .

\end{array}

}

\]

The feasible region is within the quadrant where values of \(u_1\) and \(u_2\) are non-negative. Moreover, there is an additional restriction in the budget constraint, \(RTC(u_1, u_2) \le RTC_{max}\). As will be seen, for small values of \(RTC_{max}\) this restriction can be considerable. By recognizing in advance the restrictions on the feasible region, optimization algorithms will have a smaller region to search over which to optimize, potentially improving their convergence.

As a tactic for reducing the feasible region, one might look to solutions where one selects parameter values so that transfer costs are at the maximum, that is, values of \(u_1\) and \(u_2\) so that \(RTC(u_1, u_2) = RTC_{max}\). In addition, analysts are sometimes simply given an equality constraint, “this is what you spend.” You will recall that this choice results in an active, or binding, constraint.

By restricting ourselves to feasible sets where the constraint is binding, we have reduced the number of “free” decision variables by one. This can be especially useful in the case of two risks with upper limits where there are only two decision variables; with a binding constraint, we have reduced the dimension of the problem to a single variable. That is, if a value of \(u_1\) is known, then subject to mild regularity conditions, we can solve for the value of \(u_2\) through the equation \(RTC(u_1, u_2) = RTC_{max}\). However, this tactic comes with caveats; it is also well known in the optimization literature (see for example, Nocedal and Wright (2006), Section 15.3) that this approach can introduce some subtle errors into the problem formulation. As summarized by Nocedal and Wright (2006), “Elimination techniques must be used with care, however, as they may alter the problem or introduce ill conditioning.”

Budget Restriction

As introduced in Section 3.2, the risk transfer cost \(RTC\) is the expense associated with offloading risks. You can think of limiting the \(RTC\) by a fixed amount, \(RTC_{max}\), as our budget restriction. As with all constrained optimization problems, imposing a constraint can restrict the feasible set of candidate parameter values.

To develop intuition, we make two simplifying assumptions. First, let us focus on risk transfer costs that are additive so that we may write \(RTC(u_1,u_2)\) \(= RC_1(u_1)\) \(+ RC_2(u_2)\), where \(RC_j(u)\) is the risk transfer cost for the \(j\)th risk, \(j=1,2\). As will be discussed in Section 7.5.1, this is a very natural assumption to make with separate risk transfer agreements.

Second, consider “fair” risk costs of the form \(RC_j(u) = \int^{\infty}_u [1-F_j(x)]dx\) for \(j=1,2\), as in equation (3.4). It is easy to extend this fair risk cost using multiplicative constants to allow for administrative expenses. Alternatively, risk managers may prefer to use measures such as quantiles for risk costs instead of expectations.

Guidelines for Setting the Maximal Risk Transfer Cost