The Trilemma, International Currencies, Capital Controls and Financial Development

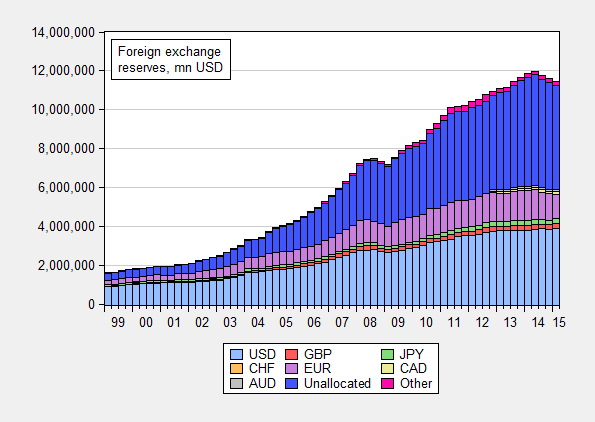

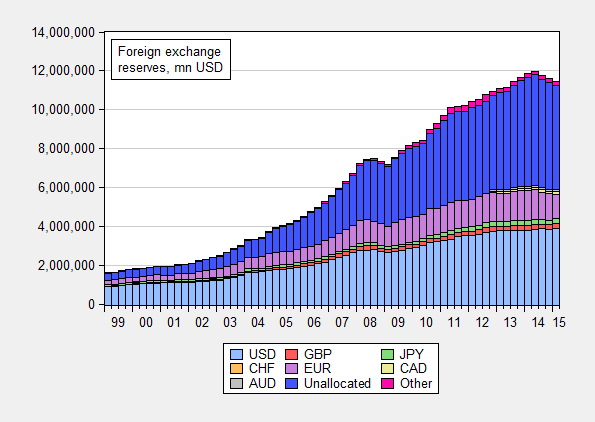

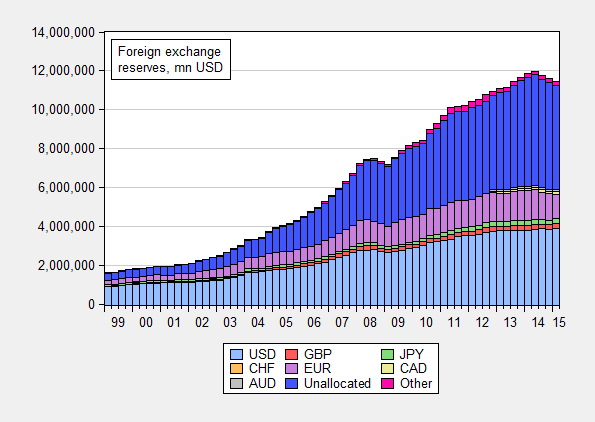

Source: IMF, COFER June 2015

Instructor

Professor Menzie Chinn

email:

mchinn@lafollette.wisc.edu

Home Page

Syllabus in PDF file.

A Note on the Exam: The final exam will be one hour long, and entail answering in essay form (w/equations, graphs if appropriate) several major questions regarding key topics in the course. The exam is close book/closed note. Please bring writing paper to provide your answers on.

The course will cover the key concept in international finance, namely the choices imposed by the international trilemma (also known as the impossible trinity), the proposition that a country cannot simultaneously pursue full monetary autonomy, exchange rate stability, and financial integration/absence of capital controls. Considerable attention will be devoted to issues of measurement and estimation of the effects of policy combinations. Finally, the linkage of financial integration to financial development and to the internationalization of currencies will be examined.

Course Materials and Sources of Economic Information

Downloadable Course Materials

Required Readings

- [1] Aizenman, Joshua, Menzie Chinn and Hiro Ito, 2013, “The “Impossible Trinity” Hypothesis in an Era of Global Imbalances: Measurement and Testing,” Review of International Economics 21(3): 447-458. [PDF]

- [2] Aizenman, Joshua, Menzie Chinn and Hiro Ito, 2010, “The Emerging Global Financial Architecture: Tracing and Evaluating the New Patterns of the Trilemma's Configurations,” Journal of International Money and Finance 29: 615-641 (with Joshua Aizenman and Hiro Ito). [PDF]

- [3] Aizenman, Joshua, Menzie Chinn and Hiro Ito, 2011, “Surfing the Waves of Globalization: Asia and Financial Globalization in the Context of the Trilemma,” Journal of the Japanese and International Economies 25: 290-320. [PDF]

- [4] Rey, Helene, 2013, “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence,” prepared for the 2013 Jackson Hole Meeting. [PDF]

- [5] Klein, Michael and Jay Shambaugh, 2015, “Rounding the Corners of the Policy Trilemma: Sources of Monetary Autonomy,” American Economic Journal: Macroeconomics 7(4): 33 – 66. [PDF]

- [6] Aizenman, Joshua, Menzie Chinn and Hiro Ito, 2015, “Monetary Policy Spillovers and the Trilemma in the New Normal: Periphery Country Sensitivity to Core Country Conditions,” mimeo (August). [PDF]

- [7] Quinn, Dennis, Martin Schindler, and A. Maria Toyoda, 2011, "Assessing measures of financial openness and integration." IMF Economic Review 59(3): 488-522. [PDF]

- [8] Ostry, Jonathan, Atish Ghosh, Karl Friedrich Habermeier, Luc Laeven, Marcos Chamon, Mahvash Qureshi, and Annamaria Kokenyne, 2011, “Managing Capital Inflows; What Tools to Use?” IMF Staff Discussion Note No. 11/06. International Monetary Fund. [PDF]

- [9] Chinn, Menzie and Hiro Ito, 2006, “What Matters for Financial Development? Capital Controls, Institutions and Interactions,” Journal of Development Economics 61(1): 163-192. [PDF]

- [10] Chinn, Menzie and Jeffrey Frankel, 2007, “Will the Euro Eventually Surpass the Dollar as Leading International Reserve Currency?” in R. Clarida (ed.), G7 Current Account Imbalances: Sustainability and Adjustment (U. Chicago Press), pp. 285-322. [PDF]

- [11] Chinn, Menzie, 2015, “Emerging Market Economies and the Next Reserve Currencies,” Open Economies Review 26(1): 155-174. [PDF]

- [12] Ito, Hiro and Menzie Chinn, 2015, “The Rise of the “Redback” and China’s Capital Account Liberalization: An Empirical Analysis on the Determinants of Invoicing Currencies,” in Renminbi Internationalization: Achievements, Prospects, and Challenges, edited by Barry Eichengreen and Masahiro Kawai (Brookings Institution Press for ADBI). [PDF]

Additional Optional Readings/Links

- Chinn, Menzie, 2006, "The (Partial) Rehabilitation of Interest Rate Parity in the Floating Rate Era: Longer Horizons, Alternative Expectations, and Emerging Markets," JIMF26 (2006): 7-21. [PDF]

- De Gregorio, Jose, Sebastian Edwards, Rodrigo Valdes, 2000, "Controls on Capital Inflows: Do They Work," JIE 63. [PDF]

- Forbes, Kristin, 2007, "One cost of the Chilean capital controls: Increased financial constraints for smaller traded firms," JIE 63. [PDF]

- Forbes, Kristin, Marcel Fratzscher, Thomas Kostka, Roland Straub 2011, "Bubble Thy Neighbor: Direct and Spillover Effects of Capital Controls," mimeo. [PDF]

- Sahay, Ratna et al., 2015, "Rethinking Financial Development," IMF Staff Discussion Note 15/08. [PDF]

- Chinn, Menzie, 2014, “Global Supply Chains and Macroeconomic Relationships in Asia,” in Asia and Global Production Networks, edited by Benno Ferrarini and David Hummels (Edward Elgar for ADB, 2014). [PDF]

- Prasad, Eswar, 2015, "The Renminbi’s Ascendance in International Finance," paper prepared for Federal Reserve Bank of SF conference/Asia Economic Policy Conference. [PDF]

- Eichengreen, Barry, Livia Chitu, Arnaud Mehl, 2014, "Stability or Upheaval? The currency Composition of International Reserves in the Long Run," ECB Working Paper 1715 [PDF]

News Sources

Other

Weblogs

Economics and Economic Policy Links

International Organizations

Current and Historical Data

- NBER catalog of International Finance data

- Economist Economic Indicators

- Note: IMF, International Financial Statistics, and World Bank, World Development Indicators, available from DISC.

- St. Louis Fed economic database Thousands

of time series on economic activity, in an easily downloadable form.

- Economic Indicators Publication of CEA and Congressional Joint Economic Committee contains

recent economic data.

- Bureau of Economic Analysis, Dept. of Commerce Data on GDP and components (the national income and product accounts) as well as other macroeconomic data.

- Bureau of the Census, Dept. of Commerce Data on the characteristics

of the US population as well as of US firms.

- Bureau of Labor Statistics, Dept. of Labor Data on

wages, prices, productivity, and employment and unemployment rates.

- Energy Information Agency, Dept. of Energy Data on

on energy (electricity, gas, petroleum) production, consumption and prices.

- Bank for International

settlements Effective Exchange Rate Indices.

- Economic Report of the President, various years. The back portion of

this annual publication contains about 70 tables of government economic data.

- NBER Data Specialized economic databases created by

economists associated with the National Bureau of Economic Research.

- NBER listing of economic releases Compendium of links to economic releases, and archived releases.

- Pacific Exchange Rate Service.

- Federal Reserve Board data Monetary, financial and output data

collected by the Nation's central bank.

- Penn World Tables Annual GDP and other data for over a hundred countries, expressed

in dollars, after adjusting for differing price levels.

The Trilemma, International Currencies, Capital Controls and Financial Development/ Universität Leipzig / mchinn@lafollette.wisc.edu / 21 December 2015